According to ConsumerShield, there are between five and six million crashes, depending on the year. Insurance is a legal requirement, but deciding when to call your insurer and which insurer to call first is challenging.

Key Takeaways

-

Seek medical attention and report your accident to the police before calling anyone else.

-

Your first call should be to your insurance company, as they can provide valuable aid when they’re notified.

-

Avoid speaking to the other driver’s insurance company or giving a recorded statement, as your words could be used against you to reduce or invalidate your claim.

-

Insurance companies determine fault by gathering all available evidence, including photos, police accident reports, and eyewitness accounts. Note that your premiums may still rise even if you are not at fault.

-

Beware that state laws and your own insurance policy may obligate you to report an accident within a certain time period.

-

Enlist legal help from a San Antonio Car Accident Lawyer to build your case and avoid falling victim to underhand insurer tactics.

Someone Hit My Car, Whose Insurance Do I Call?

Always call your insurance company first to inform them that you have been in an accident. This applies whether you live in a state with no-fault insurance laws or a state like Texas, which is an at-fault state.

In a no-fault state like Florida, your insurance company pays for any damages caused to your person or vehicle. Only if your policy limits are lower than your damages would you pursue the other driver’s insurance company.

Even in at-fault states, where the other driver’s insurer pays, there are several reasons why you should always call your own auto insurance company first, including:

-

Some insurers will help you negotiate a settlement with the other driver’s insurance company.

-

Your own insurer may provide financial help to pay for repairs and medical costs while you pursue your claim.

-

Drivers with towing coverage can get their car towed without paying out of their own pockets.

-

States with Medpay coverage will cover your initial healthcare costs.

-

Your insurer may need to defend you if the other driver attempts to blame you for the accident.

-

Your insurer needs to know the details if the other driver’s auto insurer contacts them.

-

Accidents impact your insurance policy, and not being transparent and honest in reporting your accident could invalidate it.

-

If you carry underinsured or uninsured coverage, your insurer might pay for some or all of the damages.

According to the National Bureau of Economic Research (NBER), accidents claim over 40,000 lives per year, but they credit mandatory insurance laws for reducing this number. Relying on your own insurer is vital in the aftermath of an accident, which is why we recommend calling your own insurer first.

Was the Accident Not Your Fault? Here’s How to Deal With the Other Driver’s Insurance

You may be contacted by the other driver’s insurance company. You’re under no legal obligation to talk to them and nor should you. If the other driver was at fault, anything you can and do say can be used against you by the other insurer to avoid paying out. Redirect all communications to your lawyer.

Speaking to the other driver’s insurance company directly is never a good idea, especially when you’re emotional after an accident. They’re not your friend, and in the worst-case scenario, something you say could be used to invalidate your claim or reduce how much your insurance pay out is worth.

The only people you’re legally obligated to cooperate with are:

-

Other parties involved in the accident.

-

Law enforcement.

-

Your own insurance company.

Only two reasons exist for the other driver’s insurer to reach out: to force a quick cash settlement or to pin the blame on you. Here’s what you should say firmly if you choose to speak to them anyway:

-

You will not speak about any of the specifics of the accident.

-

You are still receiving medical treatment for a car accident.

-

You will not sign anything.

-

You will not accept money from the insurer at this time.

-

You are working with your attorney to explore your options.

They may keep calling, but all you should do is either not answer the phone or repeat the above points firmly.

Does Your Insurance Go Up After a Claim That Is Not Your Fault?

Generally, your auto insurance rates will not rise after a no-fault accident. However, some state laws and insurance policies may result in changes to your rates, even if you were not to blame for an accident.

In 2021, ConsumerAffairs reported that there were 4.2 auto collision coverage claims per 100 vehicles. Sadly, many of these people struck by an at-fault driver would have seen their insurance rates rise.

Some insurers adjust your premiums based on criteria like the number of claims and the type of claims filed. One reason is insurance companies use a surcharge schedule to decide how much your rates will rise, with factors like driving record, amount of damage, and type of accident coming into play.

Certain insurers apply this surcharge schedule whether you are at fault or not. Others may use a rating system, which is a points-based system predicting your likelihood of being in an accident. Unfortunately, they may not make a distinction between at-fault and no-fault accidents.

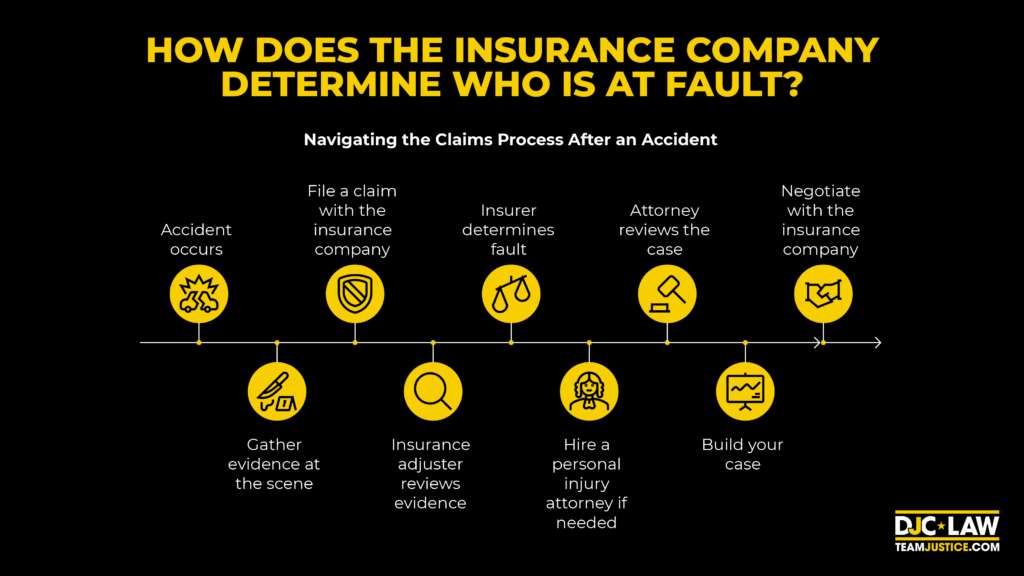

How Does the Insurance Company Determine Who is at Fault?

Insurance companies rely on teams of adjusters to determine fault by analyzing all available evidence, including the police report, photos, videos, and eyewitness accounts. They also factor in issues like traffic violations or whether a vehicle was properly maintained. In some cases, insurers may appoint accident reconstructionists.

The claims process is complex and avoids forensic investigations into every accident. That’s why lawyers always recommend that accident victims take photos and videos at the scene while also gathering eyewitness reports.

Ultimately, the goal for the insurer is to prove the policyholder wasn’t at fault. Never allow an insurance company to make the final decision. Hire a personal injury attorney to review the crash and build your case.

Should I Accept a Settlement Offer?

It depends on what the settlement offer is. If the settlement offer is similar to the value from a judgment in court, it’s often worth accepting the offer. Every situation is different, and only your lawyer can tell you whether you are getting a suitable offer.

Above all, never accept a quick cash offer from an insurance company in the aftermath of an accident. It’s common practice for insurers to attempt to lowball accident victims because they want to pay out as little as possible.

What if the Insurance Company Acts in Bad Faith?

Acting in bad faith is grounds for filing a bad-faith insurance lawsuit. Bad faith cases usually involve insurers misrepresenting their insurance policy’s language. Another driver’s insurer can commit bad faith by directly lying to you or committing fraud. All cases provide grounds for lodging an additional bad faith case.

Examples of bad faith from auto insurers include:

-

Unreasonable delays

-

Not conducting a complete investigation.

-

Offering less money than a claim is worth.

-

Deceptive practices.

-

Lying and fraud.

Sadly, it’s more common than you think. An Insurance Research Council study found that bad faith costs from the insurance industry cost Floridians $7.6 billion from 2006 to 2017. The problem is that the burden of proof lies with you, which is why you need an attorney to prove this in the face of highly complex and nuanced insurance language.

What Should I Do if the Other Driver’s Insurance Contacts Me?

Speak to them as little as possible. You are not required to communicate with the other driver’s insurance company, and you can redirect all communications to your attorney. There’s no benefit in speaking to the other driver’s insurer because they’re only calling to tempt you with a lowball offer or to get you to slip up and admit fault.

In most cases, they’ll ask you to give a recorded statement by arguing they’re getting your side of the story. What’s actually happening is they’re gathering evidence against you using misleading and awkward questions.

For example, you could say, “I’m feeling better.” as a passing comment, and these words will be used in court to downplay how serious your injuries are. Remember, insurance adjusters are highly trained to twist your words.

Never provide specifics on anything without legal representation. Ideally, avoid speaking to the other driver’s insurance company at all. Be polite but firm.

What if I Don’t Have Insurance When My Car is Hit?

Unless you live in New Hampshire, driving without a minimum amount of insurance is illegal. Getting into an accident without insurance opens you up to severe legal penalties and financial losses.

The consequences vary based on state laws and whether you’re operating under a no-fault vs. at-fault insurance system. Let’s run through the potential consequences of being involved in an accident without insurance.

At-Fault Accidents Without Insurance

-

Repair and replacement costs for the other driver.

-

Medical expenses for anyone injured.

-

All legal fees if you’re sued.

-

License suspension/revocation.

-

Vehicle impounding.

-

Fines.

-

Jail time.

-

More expensive insurance.

No-Fault Accidents Without Insurance

-

License suspension/revocation.

-

Fines.

-

Vehicle impounding.

-

All of your out-of-pocket expenses.

How Long Do You Have to Report a Car Accident to Your Insurance in Texas?

Texas law stipulates you have 30 days to report a car accident to your auto insurer. However, specific insurance policies may have shorter limits. Certain types of accidents may also require you to report your car accident to the police.

Check your insurance policy to determine how long you have to report a car accident because it could be much shorter than the general 30-day limit.

Additionally, beware that Texas law requires you to report your accident to the police immediately if your car is inoperable after an accident. Moreover, if there’s more than $1,000 in personal injury or property damage, officers must file an accident report within ten days to the Texas Department of Motor Vehicles.

If you miss your reporting deadline, your claim could be outright denied.

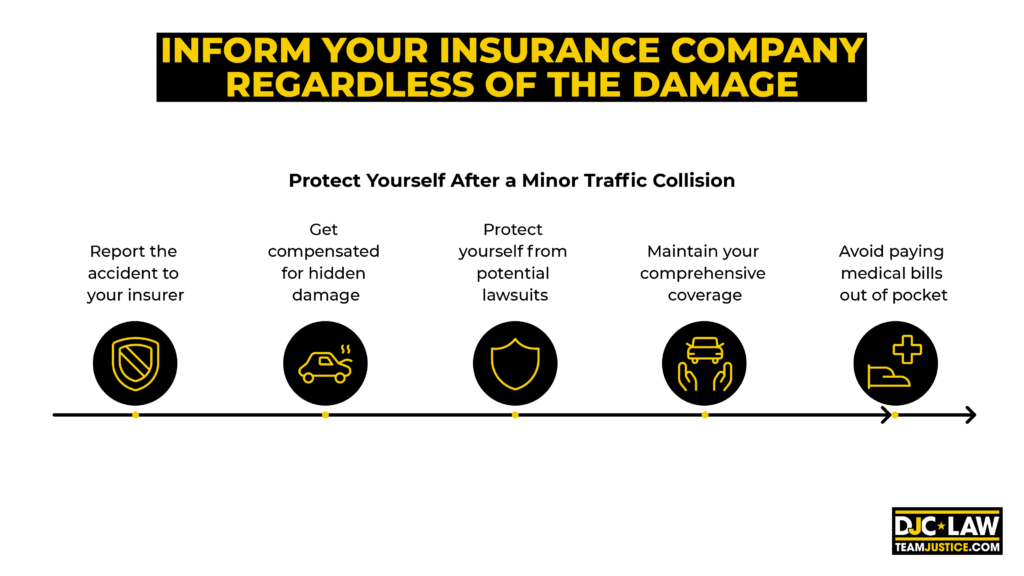

Do I Need to Inform My Insurance Company Even if the Damage Isn’t Substantial?

In many cases, you are required to report minor traffic collisions to your insurer. Even if the crash seems insignificant, calling your insurer ensures that if you find hidden damage, you can be compensated. Moreover, reporting minor crashes to your insurer protects you if the other driver decides to sue later.

Beware that many insurers require reporting of all traffic collisions, regardless of severity. If this is the case and you fail to notify your insurer of your accident, you may see your comprehensive coverage invalidated later if they find out about it.

Remember, many car accident injuries can arise days after your accident. For example, the Rush University Medical Center reports that whiplash can occur even at speeds as low as five mph. Not reporting your accident could leave you paying your medical bills out of your own pocket.

Auto Insurance Reporting FAQs

Are you Legally Required to Report All Crashes to Your Insurance Provider?

In many states, it’s not required to contact your insurance provider if the crash causes under a specific dollar amount of your bodily injury or property damage. However, most policies require all accidents to be reported, regardless of severity.

If you don’t report an accident, you risk violating your insurance policy, which could cause your coverage to be invalidated.

When Should You Call a Lawyer After an Accident?

Calling a lawyer should be one of the first things you do to build your case, negotiate with your insurance company, and deal with the other driver’s insurance company. Ideally, this should be done after seeking immediate medical attention.

Should I Pay Out of Pocket for a Car Accident?

Paying out of pocket may be required if the damages don’t exceed your deductible anyway. If not, paying out of pocket can avoid seeing your premiums increase because you don’t need to make a claim.

Whether you pay out of pocket for a car accident or not largely depends on the costs of your car accident.