Pursuing a personal injury claim or accepting an insurance settlement offer could leave you without enough to cover your medical bills. Depending on how you approach your claim, you could be left without a sufficient amount of compensation, thus forcing you to pursue another claim or having no recourse at all.

Understanding what options you’ve got available to you is critical if you find yourself in this situation so you aren’t paying out-of-pocket for someone else’s negligence. In this article, we’ll cover what to do if your settlement amount doesn’t cover your medical costs.

Key Takeaways

-

You can ask for additional compensation from your own insurer if your settlement doesn’t cover your medical bills.

-

Accident attorneys can negotiate your medical bills down or request a payment plan to help you manage your expenses.

-

Medical bills don’t have to be paid out of your settlement. However, your insurance provider can put liens on your settlement to recover monies paid to cover your bills.

-

Accident victims can negotiate their medical bills down if they feel inflated or may cause significant hardship. Negotiations have a higher chance of success if managed through a legal professional.

-

Getting the best settlement award only happens with legal representation on your side. Compensation amounts are influenced by your losses and the severity of those losses.

-

Most personal injury compensation awards are dispensed within a year of your accident.

What If My Medical Bills Are More Than My Settlement Amount?

If your medical bills exceed your injury settlement, there are steps you can take. Review your settlement agreement and check for clauses and limitations relating to medical expenses. You may have the option to enter settlement negotiations with your insurer about covering excess medical costs if you can support your case with sufficient evidence.

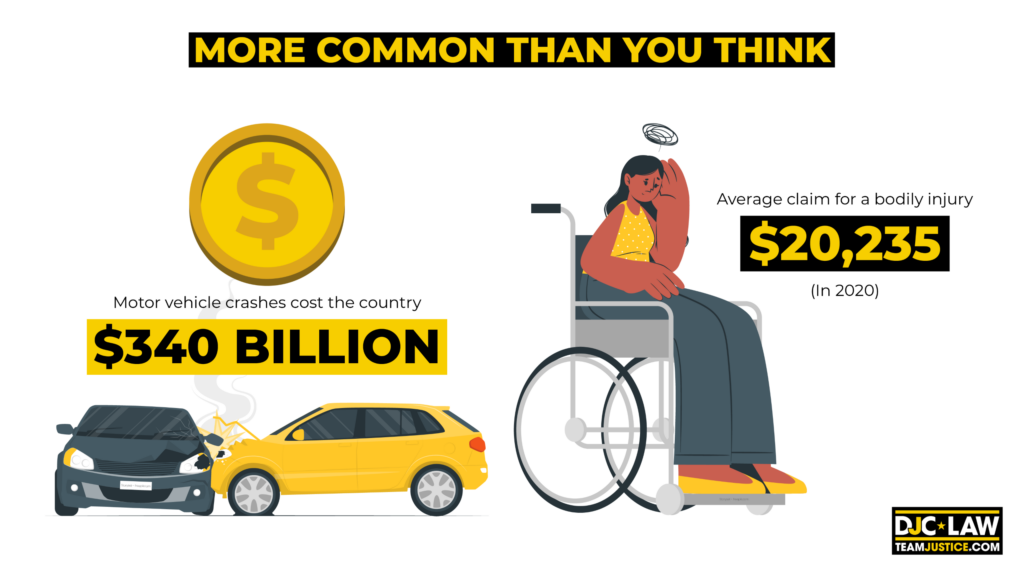

Believe it or not, this scenario is more common than you think when you go through your medical bills or statement of charges for all health-related services rendered. According to a report from the National Highway Traffic Safety Administration (NHTSA), motor vehicle crashes cost the country $340 billion in 2019.

Plus, it’s no secret how expensive American medical bills can be. With the Insurance Information Institute reporting the average claim for a bodily injury after a car accident was just $20,235 in 2020.

Your insurer could still cover excess medical bills if your settlement agreement allows it, but no insurance company wants to pay up if they don’t have to. That could leave you struggling to pay out of pocket in the meantime. If this happens to you, it’s worth hiring a Texas personal injury lawyer to explore your legal options.

Do I Have to Pay Medical Bills Out of My Settlement?

You aren’t required to pay medical bills through a settlement. Your health insurance company could cover your bills minus your deductible. Healthcare providers will use your insurance information to bill your carrier. Many state-sponsored insurance packages or Personal Injury Protection (PIP) will already have coverage for medical bills arising from accidents.

However, CBS News reported more than 8% of Americans didn’t have health insurance in 2024. In this case, you may be able to organize a payment plan with your medical care provider. If you have a low income or cannot pay, you may even be able to negotiate a reduction in your bills. Again, this is another area a personal injury lawyer can help with.

Do I Have to Pay My Insurance Company Back After an Accident?

The answer may be yes, depending on your insurance policy. Your health insurer could try to recover any money they paid for your injuries. However, this doesn’t necessarily mean you’re set to lose your entire personal injury settlement.

Firstly, if you file a lawsuit against the other party and win, your health insurer could demand you pay back what they spent on your treatment. If this is the case, they’ll put a lien on your recovery, allowing them to get paid from your settlement. Your personal injury attorney can negotiate with your insurer to reduce the size of your lien.

On the other hand, if you don’t file a claim for your injury, your medical insurance provider might go after the person who caused your insurer using a process known as subrogation.

Subrogation essentially means they’ll step into your shoes and take legal action against the person who caused your injuries. Plus, even if you do sue, your insurer can also sue, prohibiting you from recovering a specified amount used on your medical care.

Every state has its own rules on medical reimbursement for insurers. For example, over in Georgia, there’s the “made-whole doctrine” that only allows health insurers to recover funds if it’s more than the amount of the injured party’s economic and noneconomic losses plus the costs of filing a lawsuit.

Can Medical Bills Reduce My Settlement?

Your medical bills may reduce your final settlement award in some situations. This tends to happen when your medical bills are exceptionally high and your settlement doesn’t cover all your expenses.

Your personal injury attorney can step in and deal with your medical providers to either work out a payment plan or reduce your bills.

Strictly speaking, medical bills don’t reduce the amount you can claim, but they can reduce how much you actually receive, especially if your health insurance provider has a lien on your settlement.

How Do I Pay My Medical Bills if My Settlement Is Too Low?

When your settlement is too low to cover your medical bills, you could negotiate lower bills or put yourself on a payment plan. However, you could still have legal options to pursue, including filing a claim against your own auto insurance company.

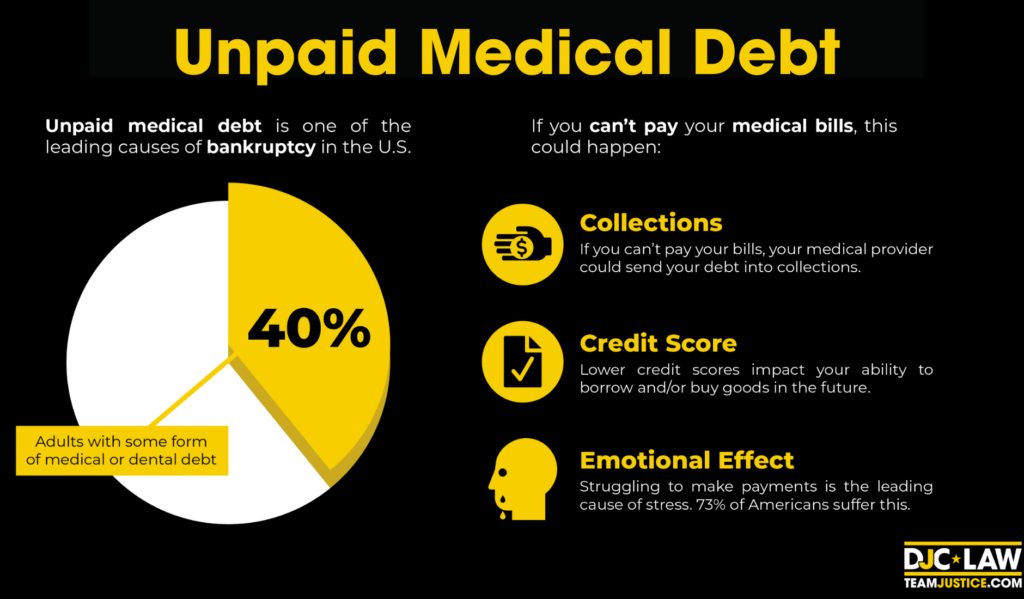

Unpaid medical debt is a serious problem and can leave you in a world of hurt. It’s one of the leading causes of bankruptcy in the U.S., and the Commonwealth Fund found that as many as 40% of U.S. adults have some form of medical or dental debt.

So, what could happen if you can’t pay your medical bills because your settlement is too low?

-

Collections – If you can’t pay your bills, your medical provider could send your debt into collections.

-

Credit Score – Not paying your medical bills impacts your credit score. Lower credit scores impact your ability to borrow in the future, such as if you want to buy a home or vehicle.

-

Emotional Effect – Struggling to make payments is a leading cause of stress, which hits your physical and mental health. CNBC News reported that 73% of Americans said finances were their leading cause of stress.

It’s a position nobody wants to be in, especially if it wasn’t your fault in the first place. Generally, you’ve got three options if you can’t pay your medical bills.

1. Negotiate With Your Medical Provider

Begin by negotiating with your medical provider, whether a clinic, hospital, or other provider. If you offer to pay in full, you might be able to negotiate a discount. Some medical providers also offer discounts if you have a low income, qualify for a specific welfare program, or are paying in cash.

2. Establish a Payment Plan

Pay your medical plans in stages by setting up a payment plan. Many providers offer 12-to 24-month payment plans to spread your balance without incurring interest. Some medical providers partner with third parties to provide low-interest loans over longer periods.

Ensure you go over your proposed payment plan carefully. Every payment plan has its own terms and financial implications.

3. Contact a Personal Accident Lawyer

If your settlement doesn’t cover your medical bills, another option is to weigh up your options with a personal injury attorney. Most attorneys offer a free consultation where you can find out about which legal options are open to you.

For example, if you settled after a car accident, you might not have the option to claim for excess medical costs from the other driver’s insurer. In some cases, your attorney could file another claim with your auto insurer.

Can You Negotiate Medical Bills After a Settlement?

Negotiating medical bills after a settlement is a common practice because your medical expenses may be more than you expected or may contain unnecessary additional charges. Talking to your medical provider could allow you to retain more of your settlement and avoid overpaying.

Most people turn to their health insurance providers first. It’s a smart move because your insurance provider can offset your medical costs before you win your settlement. Some people even have extra auto insurance policy add-ons explicitly designed to pay their medical bills if they’re involved in an accident.

For example, MedPay offers extra financial support for any medical costs incurred because of injuries suffered in an auto accident.

If you need to negotiate with your healthcare provider or insurance company after your settlement, it’s best to do this with a personal injury attorney. Although you can do it yourself, negotiations can quickly stall unless you’ve got an experienced personal injury attorney pushing your personal injury case.

Your attorney could reduce how much you have to pay, but they could also increase your total settlement amount.

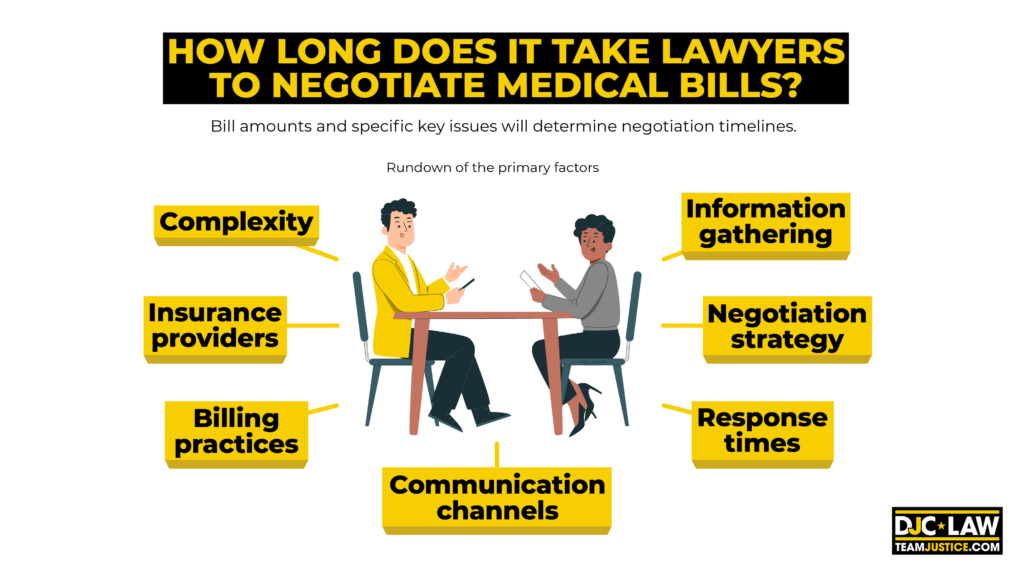

How Long Does it Take Lawyers to Negotiate Medical Bills?

Lawyers could take several weeks or several months to negotiate your medical bills. Factors influencing the decision include your insurance coverage, billing practices, the complexity of your case, and whether your medical provider chooses to cooperate or drag their heels.

The bigger your bills and precisely what your lawyer has to negotiate will be the determining factors regarding timelines. Here’s a rundown of the primary factors:

-

Complexity

-

Insurance providers

-

Billing practices

-

Information gathering

-

Negotiation strategy

-

Response times

-

Communication channels

Hiring an experienced personal injury lawyer is crucial to handle this because only they can use their expertise to give you an accurate timeline for how long you can expect to wait. Unfortunately, there’s no standardized negotiation process or timeline to lean back on.

Why Do Personal Injury Victims Receive Low Settlements?

Personal injury victims receive less-than-expected settlements because they often tackle their own personal injury cases, accept low-ball offers, and jump at the first offer that comes through. Not working with a trained legal professional is the most common reason you won’t get the highest possible settlement.

Remember, insurance companies want to pay as little as possible. It’s why they hire teams of highly paid insurance adjusters to examine every case. The rule is that if an insurer offers you X amount, there’s a high chance it’s a fraction of what you could be entitled to.

Many people want to move on from their accidents as soon as possible. It’s a perfectly natural reaction, but this is a mistake. Did you know that the Nolo legal encyclopedia found that, on average, lawyers achieve four times larger settlements than people who try to go it alone?

Besides, how do you know what a good settlement is? That’s why having legal counsel is worth its weight in gold.

What Happens to My Medical Bills if I Hire a Personal Injury Attorney?

Your medical bills still have to be paid while your case is pending. Hiring an Austin personal injury lawyer doesn’t suspend your medical bills, and you can’t suspend your medical treatment. However, lawyers can negotiate a suspension of your bills or may even offer pre-settlement loans in the meantime.

Personal injury attorneys don’t just file your case. They have your best interests at heart. Being represented by a legal professional enables them to speak to your medical providers and ask for the following:

-

A payment plan

-

A reduction

-

A suspension

Some medical providers may agree to your lawyer’s request, especially if it’s a high-value case and the issue isn’t negligence but securing a fair settlement amount. Ultimately, it’s up to the medical provider, and no law requires them to offer support while your case is ongoing.

However, some personal injury law firms offer pre-settlement loans. Essentially, this is a financial arrangement enabling you to take out a loan against your settlement. Once your case is settled, the outstanding amount will be taken out of your award.

How Can I Get the Best Possible Settlement?

Obtaining a fair settlement requires hiring an attorney who can assess the true dollar value of your claim and build a compelling case that forces a higher settlement. Crucially, lawyers ensure you don’t fall victim to a low-ball settlement offer from an unscrupulous insurance company.

Personal injury attorneys level the playing field and cover all the bases, enabling you to claim for everything from medical bills and lost income to loss of companionship and pain and suffering.

But what influences your settlement amount?

-

Injury Severity – How injured you are and the impact of those injuries on your life will influence how much you’re entitled to. The highest settlements come from chronic and life-long injuries, such as those that eliminate your ability to work. Attorneys will go through your medical records to argue your case.

-

Liability – Proving negligence is the first hurdle lawyers must overcome in building a case. Many states operate on modified comparative negligence laws, including Illinois, which assigns blame in percentage terms. For example, if you’re assigned 30% of the blame, you’ll receive 30% less in settlement monies.

-

Current and Future Medical Treatment – Your immediate medical bills matter, but if you require ongoing treatment, this will also be factored into your settlement amount. For example, if you need medication for life, this will be part of the settlement calculations.

-

Lost Wages – Did you have to take time off work? You’re entitled to claim for these lost wages. Likewise, if you cannot return to work at all because of a disability, this will have a tremendous impact because it accounts for your lost future earnings potential.

-

Pain and Suffering – Your mental and emotional pain also comes into play. This can include loss of companionship and your general loss of enjoyment of life if your injuries are life-changing.

The value of an attorney is in securing you the best settlement through exploring the avenues the average layperson would never consider. Bear in mind that your insurer doesn’t want to give you a fair settlement, but they also don’t want to go to court, either.

How Long Does it Take to Get a Settlement?

Most personal injury claims are settled within a year, with payments being disbursed within a few days to a few weeks after confirming a settlement amount. However, some cases can drag on for years if they’re particularly expensive or complex.

Speak to a lawyer to get a firm answer to the question, “How long does it take to get your injury settlement?”. Every case is unique and only an experienced attorney can accurately predict how long you could be waiting for your settlement.

Post-Settlement Medical Bills FAQs

How do you argue down medical bills?

Get a copy of your medical bills and check for unnecessary or gratuitous charges. Make it clear that paying the requested amount would represent a financial burden. Provide evidence of hardship, such as low income, lack of assets, or an inability to work.

Always enlist a lawyer because they’ll work tirelessly to argue with your medical provider and use every strategy in the book.

Can I sue for additional compensation to cover my medical expenses?

In nearly all cases, you cannot sue the same party over the same issue multiple times. Accident victims can’t do this even if they feel their compensation award wasn’t enough. If you can’t cover your medical bills, there may be options. For example, if you took a settlement from your own insurer, you could sue the other person’s insurer.

What is the longest a settlement can take for my medical bills?

No limits exist on how long settlements could take. Cases in the past have taken years to resolve, especially if they involve seven and eight-figure amounts or there are questions surrounding liability. However, most personal injury settlements are confirmed and paid within a year.