Claiming on your auto insurance after an accident lets you get reimbursed for your losses. Consumer Affairs found that 4.2% of drivers made an auto collision insurance claim in 2021, but thousands of claims were also denied for one reason or another.

If your claim is denied, this isn’t the end of the matter. You can appeal your insurance denial, and the best way to do this is with the help and support of an Austin Car Accident Attorney.

Understanding why claims are denied, what happens next, and what to do about it will enable you to get the compensation you deserve.

Key Takeaways

-

If your car insurance denies your claim, you’ll receive a denial letter outlining why it was denied and your next steps.

-

Failure to get your insurance claim approved means you’ll have to pay all costs out of pocket, including medical bills, property damage, and car repairs.

-

Insurers enable you to appeal your claim or file a personal injury claim.

-

The most common reasons for a claim denial include lapsed policies, insufficient coverage, and incomplete documentation.

-

After a claim denial, review the information with your lawyer, gather evidence to build your case, and appeal and/or file an official complaint.

-

Hire a lawyer to help you understand your reason for denial, build your case, file complaints, and pursue a lawsuit against the insurer and/or the other driver.

What happens if an insurance claim gets denied?

Your insurer will send you a claim denial letter if your car insurance claim is denied. This letter will outline the reasons why your claim was denied and provide information about how you can appeal said decision.

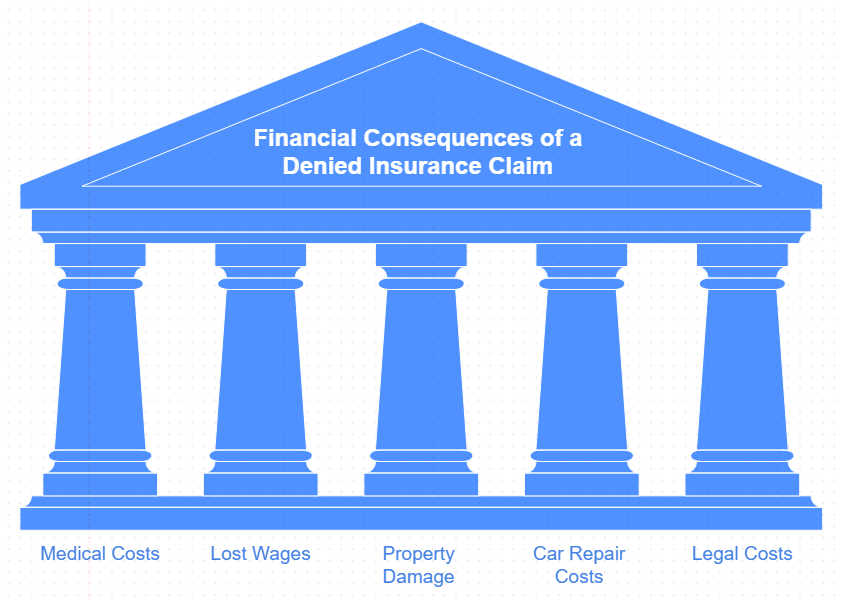

If your insurance claim is denied, your auto insurer refuses to provide a payout, meaning you’ll have to pay your own costs. Examples of these losses include:

-

Medical costs

-

Lost wages

-

Property damage

-

Car repair costs

-

Legal costs

It can be devastating, but this isn’t something you just have to accept. Options exist for dealing with a denied insurance claim.

How Do I Respond To a Denied Insurance Claim?

Study why your claim is denied and decide whether you have a reasonable chance of appealing your claim. Your denial may have been made in error. Review the documentation and gather the evidence you need to appeal.

The reason why your claim was denied will be crucial. For example, if your claim was denied because your coverage lapsed two weeks before the crash, you have no chance of reversing the decision.

If you don’t feel comfortable dealing with a car accident claim denial yourself, consult your personal injury attorney.

How Do I Appeal a Denied Car Insurance Claim In Texas?

You can always appeal a denied insurance claim if you believe that an error has taken place. The burden of proof is on the policyholder to prove the insurer made a mistake. Gather evidence, including photographs, medical reports, police reports, and other evidence, to build your case.

With your evidence in hand, you’ll draft an appeal letter that formally asks the insurance company to review their decision. Your appeal letter must detail why you disagree and why each piece of information shows they have mistakenly denied your claim.

Practically every insurer follows the same claims process. Call your lawyer if you need help drafting a letter and building your argument.

What Are The Common Reasons a Car Insurance Claim Could Be Denied?

The first step is to understand why the insurance company denied your claim. There are many reasons why a car insurance company denies claims, often related to car insurance policy terms, the details of the accident, or the evidence provided.

Whatever the reason, the auto insurance company should provide you with a written explanation outlining the reason for denial. This will help you determine the best course of action moving forward. Here are some common reasons for denial:

Policy Exclusions

Insurance policies typically list specific scenarios that are not covered. If your accident falls into one of these excluded categories, the insurance company may deny your claim. Common exclusions include accidents involving illegal activities or driving under the influence.

Lapsed Insurance Policies

If the insurance policy was not active at the time of the accident due to non-payment of premiums or cancellation, the insurance company will deny the claim. Maintain continuous coverage.

Insufficient Coverage

The policy may not cover certain types of damage or may have limits that are exceeded by the cost of the accident. For instance, if you only have liability coverage and the crash damaged your vehicle, your policy may not cover the repairs.

Disputed Liability

Insurance companies might deny a claim if they believe their policyholder is not at fault for the accident. This can also happen if there is a dispute over the degree of fault. For example, Texas follows a modified comparative fault rule, meaning that the amount of compensation you’re entitled to can be reduced by your percentage of fault in the accident. If you are more than 50% at fault, you cannot recover damages.

Failure to Report the Accident

Policyholders are typically required to report accidents within a certain timeframe. Failing to do so can result in a claim denial, as it could affect the insurer’s ability to investigate.

Incomplete Documentation

Claims often require extensive documentation, including police reports, witness statements, and proof of damages. Inadequate or missing documentation can lead to denial.

Questionable or Fraudulent Claims

If an insurance company suspects a claim is fraudulent or exaggerated, it will investigate further and may deny the claim if evidence supports these suspicions.

Pre-existing Damage

Claims may be denied if the insurance company believes the damage was pre-existing and not a result of the reported accident.

Violation of Policy Terms

Engaging in activities that violate the terms of the insurance policy, such as unauthorized drivers using the vehicle or using the vehicle for commercial purposes without proper coverage, can lead to claim denial.

Steps to Take After a Claim Denial

Once you understand why the insurance company denied your claim, you can bolster your claim if you:

-

Review the Denial Letter Carefully With a Lawyer: The first step is thoroughly reviewing the denial letter. Insurance companies are required to provide a reason for the denial. Understanding their justification is key to challenging the insurance company’s decision.

-

Gather Additional Evidence: If your claim was denied due to insufficient evidence or a disputed fault, gather more evidence. This can include medical bills, photos of the scene, witness statements, police reports, or anything else that can support your claim.

-

Appeal the Decision: Most insurance companies have an internal appeal process. You can submit the additional evidence you’ve gathered and argue why it should reconsider your claim.

-

Consult an Attorney: Often, the best course of action is to consult a legal professional. An attorney who handles car accident claims can provide valuable advice on how to proceed. They can help you navigate the appeal process or represent you in legal actions if necessary.

-

Consider Mediation or Arbitration: If the dispute cannot be resolved through the insurance company’s appeal process, mediation or arbitration might be a viable next step. Both are alternative dispute resolution methods that can be less costly and time-consuming than going to court.

-

File a Complaint: If you believe the insurance company has acted in bad faith, you can file a complaint with the Texas Department of Insurance. They can investigate the matter and may provide assistance in resolving the dispute.

-

Legal Action: As a last resort, you may consider filing a lawsuit against the insurance company. Let your attorney do this. They can assess the strength of your case and advise on the likelihood of success.

What Not to Do in Car Insurance Claims?

Provide only the information you’re required to provide. Never admit fault, speculate, or overshare information. Allow your lawyer to take charge of negotiations and brief you on handling proceedings if you are forced to provide information.

Follow these rules for what not to do while claiming:

-

Don’t volunteer extra information.

-

Don’t speculate.

-

Don’t admit or imply fault.

-

Don’t negotiate with the other driver directly.

-

Don’t provide a sworn statement to the other driver’s insurer.

-

Don’t make your injuries worse by not following your doctor’s recommendations.

-

Don’t accept an insurance adjuster’s evaluation.

-

Don’t sign any settlement without a lawyer.

-

Don’t sign a blanket medical authorization.

-

Don’t attempt to claim or sue without the help of an attorney.

Remember, insurance companies aren’t your friends. They want to minimize the amount they pay, and they pay hundreds of thousands of dollars to hire adjusters who will save them money. Let your attorney do the talking and handle each step.

What if My Car Accident Claim Is Denied More Than Once?

Most insurers won’t allow you to appeal a claim denial multiple times. Consult your lawyer on filing a lawsuit if your claim has been denied multiple times. However, some insurers may provide extra instructions for other courses of action after a second denial.

Note that filing a lawsuit, such as due to bad faith practices, doesn’t mean you’ll have to endure a jury trial. Your insurer may settle out of court if they know you’re serious about legal action.

What if My Insurance Company Acts in Bad Faith?

Committing bad faith against policyholders means your claim could be wrongly denied. If you find they have violated their policy terms, you can file a bad faith lawsuit against them for breach of contract.

Bad faith cases must demonstrate why the insurer violated their terms and provide clear evidence that the insurance company has not acted in good faith. If you win your case, your insurer may have to pay your original claim plus compensation.

What Damages Are Available to Car Accident Victims?

In Texas, after a car accident, you may recover damages, depending on your case. Damages in Texas are generally categorized into economic damages and non-economic damages. Here’s a breakdown:

Economic Damages

These are tangible, out-of-pocket expenses that bills and receipts can document.

They include:

-

Medical Expenses: Costs for medical treatment related to injuries from the accident, including hospital bills, medication, physical therapy, and any future medical care related to the accident injuries.

-

Lost Wages or Income: Compensation for the income lost due to time off work because of injuries sustained in the accident. This also covers loss of earning capacity if the injuries impact your ability to earn money in the future.

-

Property Damage: Costs to repair or replace your vehicle and any personal property damaged in the accident.

-

Other Out-of-Pocket Expenses: Any other direct expenses incurred because of the accident, such as rental car fees and transportation costs to medical appointments.

Non-Economic Damages

These damages are intended to compensate for car accident losses that aren’t easily quantifiable with a receipt or invoice.

They include:

-

Pain and Suffering: Compensation for the physical pain and emotional distress suffered as a result of the accident.

-

Mental Anguish: Compensation for psychological impact, such as depression, anxiety, and trauma stemming from the accident.

-

Disfigurement: Compensation for permanent changes to your appearance.

-

Physical Impairment: Compensation for long-term or permanent loss of bodily functions or mobility.

-

Loss of Consortium: Compensation for the impact of the injuries on the relationship between a victim and their spouse.

How Can a Lawyer Help Me if the Insurance Company Denied My Claim?

Dealing with insurance companies can be daunting. Legal representation from a firm like DJC Law in Austin can make a significant difference in the outcome of your case. An experienced attorney can:

Help You Understand the Denial

A lawyer can help you understand the specific reasons behind the denial of your claim. Insurance jargon can confuse you. A legal professional can interpret the language and implications for you. They can assess whether the denial is valid based on the insurance policy terms and applicable laws.

Gather and Analyze Evidence

Lawyers have experience in gathering the necessary evidence to support your claim. This includes obtaining accident reports, medical records, and witness statements. They can also arrange for testimonies from accident reconstruction experts or medical professionals to strengthen your case.

Navigate the Appeals Process

An attorney can guide you through the insurance company’s internal appeals process, ensuring you meet all deadlines and requirements. They can represent you during the appeal, presenting evidence and arguments on your behalf.

Negotiate with Insurance Companies

Lawyers are skilled negotiators who can leverage their experience and knowledge to advocate for a fair settlement. They can ensure you’re not pressured into accepting a settlement for less than what you deserve.

Pursue Legal Action

If the appeal is unsuccessful, a lawyer can help you file a lawsuit against the insurance company. They can develop a legal strategy tailored to the specifics of your case, potentially leading to a court-ordered compensation.

Advocate in Court

If your case goes to court, having a lawyer ensures you have an experienced advocate to present your case effectively. Lawyers are familiar with court procedures and can navigate the legal system on your behalf, making compelling arguments and objecting to improper evidence or procedures.

Advise on Alternative Resolutions

A lawyer can advise on alternative dispute resolution methods, such as mediation or arbitration, which can be quicker and less expensive than court proceedings.

Protect Your Rights

An attorney can explain your rights under the law and ensure that the insurance company respects those rights. They can prevent the insurance company from taking advantage of you, ensuring you are treated fairly throughout the process.

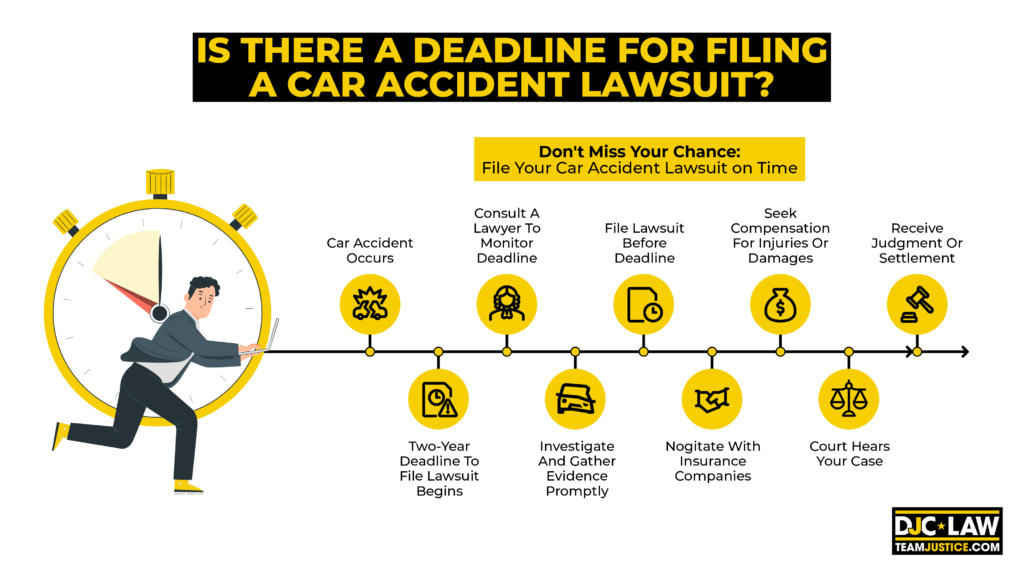

Is There a Deadline for Filing a Car Accident Lawsuit?

Yes, there is a deadline for filing a car accident lawsuit in Texas, known as the statute of limitations. For most car accident cases, including personal injury and property damage claims, Texas law sets this deadline at two years from the date of the accident. This means you have two years from the day the accident occurred to file a lawsuit against the parties you believe are at fault for your injuries or property damage.

You need a lawyer to monitor this deadline for several reasons:

-

If you attempt to file a lawsuit after the two-year statute of limitations has expired, your case is very likely to be dismissed by the court, and you will lose the opportunity to seek compensation through the court system.

-

The statute of limitations encourages prompt investigation and filing of claims, which helps ensure evidence is preserved and witness memories remain fresh.

-

Knowing this deadline can help you better navigate your negotiations with car insurance companies, as they are also aware of the time limit.

A few exceptions to the two-year statute of limitations might extend the deadline under certain circumstances, such as if the injured party is a minor or if the defendant leaves the state for a period. However, these exceptions are specific and limited, so you need a lawyer who can explain how they apply to your situation.

Given the complexity of legal claims and the importance of timely filing, it’s advisable to consult with a personal injury attorney early on if you’ve been involved in a car accident in Texas. An attorney can provide guidance on the legal process, ensure you meet all critical deadlines, and secure the compensation you deserve.

Insurance Claim Denial FAQs

Do I Need a Lawyer to Appeal My Claim?

No, you don’t need a car accident lawyer to appeal a car insurance claim denial, but it’s wise to hire one anyway. They know how to deal with underhand tactics, build your case, and use their expertise to draft an appeal later that maximizes your chance of success.

Will My Insurance Premiums Go Up With My Claim?

Generally, no, but every car insurance company uses a unique algorithm to determine their premiums. In some cases, even making a claim when you’re 100% not at fault for an accident could see you paying more every month. That’s because even being involved in an accident potentially makes you a greater risk to the insurer.

How Many Times Can I Appeal a Car Insurance Claim Denial?

It depends on your carrier and state. Most states set a statute of limitations for appeals instead of a hard limit. Some insurers may allow you to appeal multiple times. If you feel like the insurer isn’t cooperating, call a lawyer who can intervene and file a complaint with your state’s insurance department.