Accident forgiveness is a common optional extra offered by auto insurance companies. However, State Farm is one of the only major auto insurers in America that offers no form of accident forgiveness.

Look online, and you’ll see rumors that going nine years without a claim unlocks a premium accident forgiveness option, but this is false. With YouGov reporting that 50% of American drivers have claimed against an auto insurance policy, this may make you wonder if State Farm is an insurer to avoid entirely.

In today’s guide, we discuss how accident forgiveness works, how State Farm's accident forgiveness policy, and what your next steps should be if you’re involved in a collision.

Key Takeaways

Accident forgiveness is an insurance policy add-on that prevents insurers from raising your rates if you’re involved in an accident.

State Farm is the only major U.S. insurer offering no accident forgiveness. However, they offer other safe driver discounts to compensate.

State Farm continues to cover your losses after an accident, but they also retain the right to deny your claim for any number of reasons.

Accident forgiveness is seldom worth it for most drivers because the costs saved through forgiveness rarely outweigh future rate rises or the ongoing costs of maintaining this coverage.

If you’re involved in an accident that was or wasn’t your fault, speak to an attorney to push your claim and ensure that State Farm doesn’t unjustly deny you your right to compensation.

What is Accident Forgiveness?

Accident forgiveness is an extra form of coverage on your insurance policy that enables you to be “forgiven” for an accident. If forgiven, your insurance rates won’t automatically rise if you get involved in an accident. Although this sounds good, accident forgiveness comes with several caveats many drivers are unaware of.

Four points to remember about accident forgiveness include:

Not Available Everywhere – Not every state allows auto insurers to offer this product. California is one of the most significant states that doesn’t permit this product.

Not All Insurers – Insurers may offer it as an optional extra or even provide it with comprehensive coverage as standard. Insurers like State Farm don’t offer this product but may offer other options, such as safe driving discounts.

Limitations on Forgiveness – Accident forgiveness isn’t a license to crash as often as you want. Most insurers have limitations on their policies. For example, Farmers Insurance allows one accident per three years to be forgiven.

Stay on the Record – Your accident will still appear on your record regardless of whether it’s forgiven. If you ever switch insurance, your accident could still impact your premiums in the future, as they can see the accident on your record.

With this in mind, accident forgiveness coverage isn’t as straightforward as you might think. Many Americans remain tempted by it and often choose to take out this coverage, especially since Forbes reported the average rate hike for an accident that led to injuries and was your fault was 40%.

Accident Forgiveness Insurance Rules

Accident forgiveness insurance has its own rules and regulations. Not everyone can qualify for this type of coverage. Moreover, it’s critical to remember that not every type of accident is eligible for forgiveness, even if you have the necessary coverage. Most insurers will want to see a clean driving record to provide it.

For example, Farmers Flex from Farmers Insurance puts the following requirements in place:

All drivers on the policy must be over the age of 25.

All drivers must have no chargeable at-fault accidents.

All drivers may have no more than one minor/speeding citation.

All drivers must have no DUIs.

All drivers under the age of 25 cannot have any traffic citations at all.

Remember, accident forgiveness, like auto insurance generally, is tied to the vehicle, not the driver. If someone on your policy has an accident, further crashes won’t be forgiven, even if a different driver has an accident later.

Does State Farm Have Accident Forgiveness for Auto Insurance?

State Farm is unique among major American auto insurers because it does not offer accident forgiveness. However, staying accident-free still has benefits, as it offers safe driving discounts for drivers.

Some articles state that accident forgiveness is available to customers but only to drivers who have been continuous customers of State Farm for nine years without any accidents. Unfortunately, as of 2024, this is entirely wrong.

Staying accident-free with State Farm is still beneficial to your insurance premiums. Instead of accident forgiveness, State Farm provides an accident-free discount on their car insurance policies if you avoid any accidents or claims for three years.

According to Bogleheads, State Farm’s rewards work like this: Initially, drivers can receive a 10% “good driver” discount. Once they have been without accidents or claims for three years, the good driver discount disappears and becomes a 15% “accident-free” discount.

In other words, State Farm may not offer accident forgiveness, but its discounts for not claiming are significant. Essentially, State Farm offers benefits similar to those of other insurers, but it does so using different channels.

Is Accident Forgiveness Worth It?

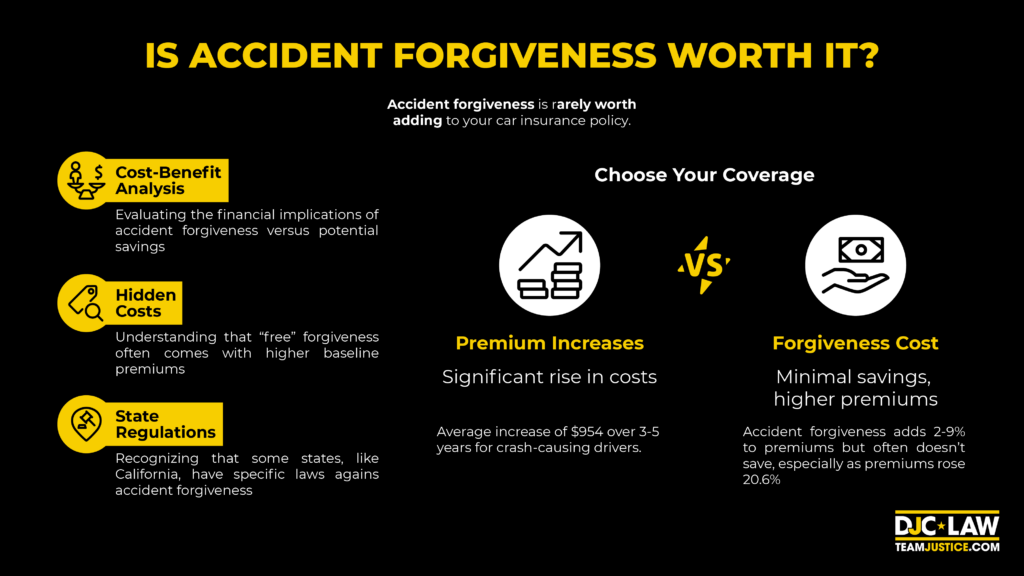

Accident forgiveness is rarely worth adding to your car insurance policy. In many cases, you’re paying extra premiums anyway, which may still rise in the long run if you’re involved in an accident.

If you want forgiveness on your insurance policy, you will pay for it in some way. Insurers who offer you this perk will mandate a price to be paid in response. Even if your insurance claims to offer it for free, your premiums are still going to be higher than if you took out a policy where it wasn’t included at all.

Regardless of how an insurer tries to sell accident forgiveness, it’s a perk that seldom pays off in the long term. Here’s an example of why it doesn’t pay off.

In California, residents voted on Proposition 103 in 1988. The passing of this law outlawed “excessive” insurance rates. Under this law, accident forgiveness as a concept was considered excessive because drivers are essentially paying for an accident that hasn’t even happened yet. That’s why California is a state where this product cannot be offered under any circumstances.

When you think that State Farm is a lesser insurer because they don’t offer it, you might want to think again.

Premium Increases vs. Accident Forgiveness Savings

Do you save money with an accident forgiveness rider on your policy? Examining the numbers reveals that the average driver wouldn’t save money apart from extremely specific circumstances.

According to a January 2024 NerdWallet analysis, the average increase in premiums on comprehensive auto insurance was $954 if you were the cause of a crash. These extra charges remain for around three to five years, depending on which insurer you’re using.

This fact alone demonstrates that forgiveness could be useful, right?

Let’s assume that you take out accident forgiveness instead. On average, it costs between 2% and 9% more in premiums. If you drive for several years without getting into an accident, you don’t save any money.

Plus, you may still receive a premium hike if you get into an accident that was your fault. Most insurers will eliminate no claims or good driver discounts even if your accident happened to be “forgiven.” With S&P Global reporting that the average cost of insurance has risen by 20.6% anyway, you’re not saving anything significant at all with accident forgiveness in your locker.

Will State Farm Cover Your Losses After an Accident?

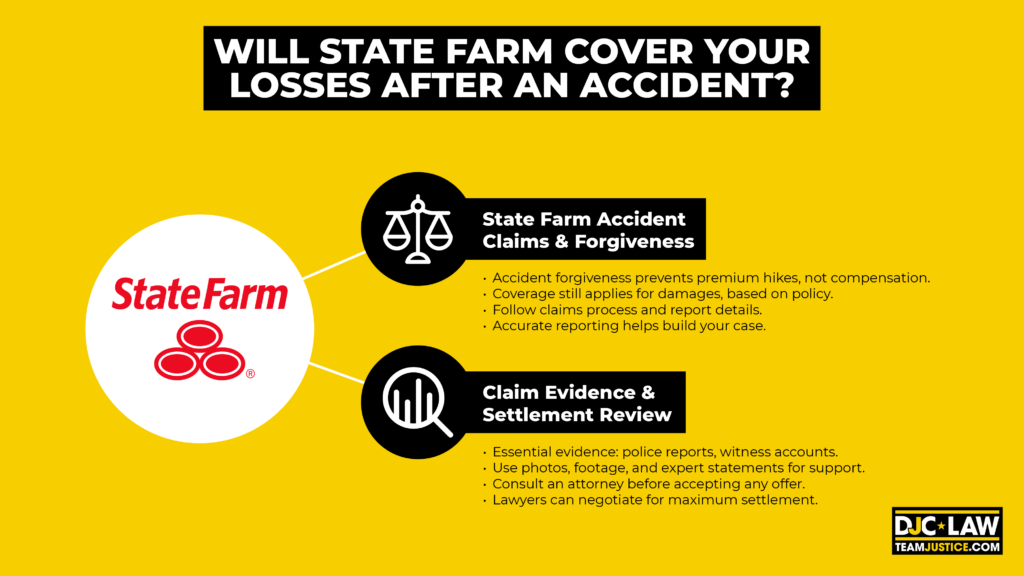

State Farm will still compensate you if you were in an accident that wasn’t your fault. Accident forgiveness has nothing to do with compensation. It only stops the insurer from raising your premiums after a car accident.

You’ll be required to go through the State Farm claims process if you were involved in an accident. Depending on what happened and your coverage, you can still receive compensation for your tangible and intangible losses. In all cases, hiring an attorney who can help you file your claim and deal with State Farm’s insurance adjusters is wise.

How Do You File an Insurance Claim With State Farm After an Accident?

Filing an insurance claim with State Farm requires you to report the accident and provide information about the crash and your losses. Your personal injury attorney can detail your losses and gather as much evidence as possible to build your case. Moreover, they’ll take control of negotiations, ensuring you get a full and fair settlement.

Some examples of evidence an attorney can use to file your claim include:

Official police reports

Eyewitness testimonies

Traffic camera footage

Photos from the crash

Expert witness testimonies

They’ll use this evidence to prove that not only was the other driver negligent and failed in their duty of care but that you suffered losses due to their inaction.

Should I Accept a State Farm Settlement?

No State Farm settlement offer should be accepted without consulting your attorney first. Most initial settlements don’t come close to what your case is genuinely worth. Your lawyer will review, negotiate, and get the highest possible settlement for you.

Never sign any deal with State Farm until your lawyer has reviewed all the paperwork. After agreeing to a settlement, getting extra compensation later is nearly impossible.

How Does State Farm's Accident Forgiveness Policy Work?

Accident forgiveness isn’t available from State Farm. Your auto insurance premiums will likely rise if you’re involved in an accident that you caused. The consequences aren’t just the initial raise in premiums but also the elimination of good drivers and no-claims discounts, which can add 15% to the cost of your premiums.

Additionally, the impact of an at-fault accident will stay on your record for at least three to five years, depending on your circumstances. Usually, accident forgiveness prevents these immediate rises.

According to Jerry Insurance, accident forgiveness stops your rates from jumping by an average of 20% if you’re in an at-fault accident. However, conditions apply, and certain types of accidents may be ineligible for any form of forgiveness.

How Much is State Farm Car Insurance?

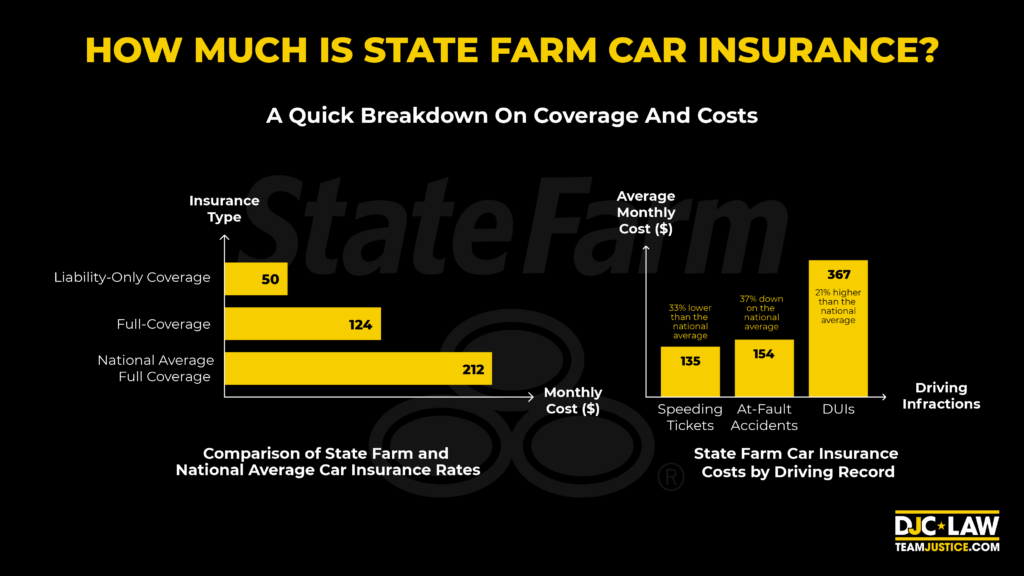

State Farm car insurance starts at an average of $50 if you purchase liability-only coverage. On the other hand, on average, full-coverage car insurance costs $124 a month, including collision, comprehensive, and liability coverage.

Per Lending Tree, State Farm is statistically the cheapest car insurance provider in the country that’s open to everybody. Lending Tree found that their average liability policy rates are 23% cheaper than the national average, with full coverage being 25% cheaper than the national average.

Despite the lack of accident forgiveness, this is what continues to make State Farm attractive to drivers as insurance rates rise. In 2024, Bankrate found that the national average cost for full coverage has now reached an eyewatering $2,543 per year, or $212 per month.

How Much is State Farm for Drivers With a Ticket, Accident, or DUI on their Records?

State Farm offers the cheapest policies for drivers with at-fault accidents and speeding tickets on their records. However, according to Lending Tree, State Farm levies some of the highest rates on drivers with DUI convictions on their records.

Here are the current figures:

Speeding Tickets – State Farm costs $135 per month on average, which is 33% lower than the national average.

At-Fault Accidents – Expect to pay $154 a month on average for your car insurance, which is 37% down on the national average.

DUIs – On the other hand, drivers with DUIs can expect to be charged $367 per month on average, which is 21% higher than the national average.

How Much Will Your Car Insurance Rates Go Up After an Accident With State Farm?

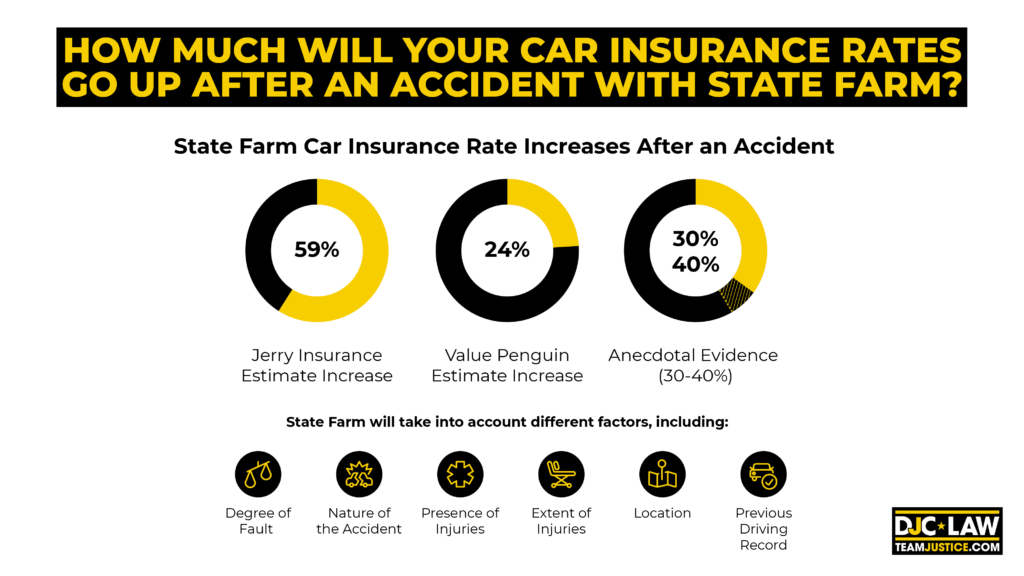

State Farm’s car insurance rates rise substantially after an accident, with average rate rises of 24% to 59%. How much your rate rises depends on who was at fault, the circumstances of the accident, and the value of the claim.

Jerry Insurance states that State Farm customers may see their rates rise as high as 59% after an accident. On the other hand, Value Penguin puts this figure at 24%. Plenty of anecdotal evidence also mentions rises of 30-40%. Unfortunately, pinning the precise number down is nearly impossible.

State Farm will take into account different factors, including:

Degree of fault

Nature of the accident

Presence of injuries

Extent of injuries

Your location

Your previous driving record

Higher rates are practically guaranteed after being involved in an accident, but they won’t stick around forever. Generally, you can expect to pay higher rates for three to five years. Afterward, the effect will disappear, and you’ll be back to paying your original rates, especially since you’ll be able to regain your no-claims discounts again.

Note that if you’re involved in further accidents in the immediate aftermath of your rate rises, you can expect to see even higher rates that last longer.

What to Do if Your State Farm Rate Goes Up

State Farm’s car insurance rates have risen significantly in the past five years. If your rates have risen, you should call to inquire about why your rates have risen to uncover the factors you can work on to reduce your rates again.

The problem is that insurance rates have spiked across all companies because of factors entirely out of your control. Nationwide inflation, increased accident rates, and the rising cost of auto parts are all elements that have driven up costs for everyone. It’s partly why USA Today reports that 14% of Americans now drive without insurance, an increase of 3% from 2019.

Sadly, there’s not much motorists can do to deal with rising rates right now. Factors outside of your control are the biggest influence on rising rates, meaning simply switching from State Farm to someone else won’t necessarily give you the discounts you’re searching for, but here are some general tips to reduce your rates:

Assess Your Coverage Options

Do you need the coverage you have? Consider your risk tolerance, financial security, and drivers on your policy. Try not to reduce your coverage limits, but get rid of any unnecessary bells and whistles like car replacement coverage or unnecessarily low deductibles.

Get a Clean Driving Record

Avoiding any at-fault accidents on your record is the best advice for reducing your premiums. Even a simple speeding ticket can result in a rate increase.

Drive Cheaper

The more expensive the car, the more it costs to insure. Drive a cheaper vehicle to enjoy lower rates. For example, Mercury Insurance’s 2023 list reveals three of the cheapest cars to insure, including the VW Golf, Chevrolet Spark, and Hyundai Accent.

Shop Around

If State Farm isn’t playing ball, consider shopping around. It’s good business to get new insurance quotes annually to ensure that you’re really getting the best rates. Sometimes, State Farm may offer extra incentives if you tell them you’re about to switch to a cheaper provider.

Add Telematics

More insurance companies now offer discounts in exchange for installing telematics on your vehicle. Essentially, this is a plug-in device or an app that monitors your driving for safe driving habits. It’s becoming increasingly popular, with TransUnion reporting a 33% increase in telematics installations in 2022.

Maximize Discounts

Insurers offer a massive number of discounts, from student and senior to military and traffic school discounts. Ask State Farm about the discounts that could be available to you, as they probably won’t flag them for you automatically.

Bundle Your Policy

Bundling your auto insurance coverage with your home insurance could yield a bigger discount. State Farm offers homeowners’ insurance and renters insurance, and they’ll give you a discount if you take out an extra policy with them.

Increase Your Credit Score

Credit score matters when determining auto insurance premiums. All insurers, including State Farm, use a credit-based insurance score (CBIS) to decide what your rates are. Work on raising your score, and you’ll see your rates fall.

If a Car Accident is Not Your Fault, Does Your Insurance Go Up?

Your insurance may still rise if you were involved in an accident that wasn’t your fault. It may seem unfair, but the auto insurance business is a risk-based business, and being involved in any form of accident increases your perceived risk.

If the accident wasn’t your fault, your premiums may still increase, but the impact won’t be as significant as an at-fault accident. Many drivers are surprised because if the at-fault party’s insurance pays for everything, why would their insurers raise their rates? Sadly, it’s just the way the industry works, and no law exists on the books in Texas to prevent this type of behavior.

Nevertheless, no-fault accident premium increases still pale compared to at-fault premium increases. According to Car and Driver, drivers in no-fault accidents see average insurance premium increases of 10%.

Let’s examine the systems in place that inadvertently lead to no-fault drivers being penalized with higher rates.

The Surcharge Schedule

Some insurers use what’s known as a surcharge schedule to decide how much to raise your rates after a claim. A surcharge schedule is a list of factors that influence your premiums, including:

Your driving record

Type of accident

Frequency of accidents

Amount of damage

Number of claims made

If you’re in a no-fault accident, an insurer might still apply a surcharge because of their own rules and regulations. No standardization exists regarding how insurers using a surcharge schedule tackle this issue.

The Rating System

Other insurance companies use a rating system. State Farm is one such insurer that relies on a rating system to decide on your premiums. In this case, the insurer utilizes a points-based system to assess how likely you are to be in an accident.

Examples of factors include:

Age

Gender

Location

Vehicle driven

Credit score

If your rates rise after a no-fault accident, it’s likely because State Farm assigned points in a particular category that increased your risk profile.

Car Insurance Companies and At-Fault vs. No-Fault States

Making things even more complex, how State Farm and other insurers treat a no-fault accident will depend on your state. Approximately 12 states have no-fault laws, meaning you claim against your insurer regardless of who was at fault.

In a no-fault state, your rates are extremely unlikely to rise if you weren’t at fault for the accident. Only if you’re someone who makes frequent claims are you likely to pay higher rates.

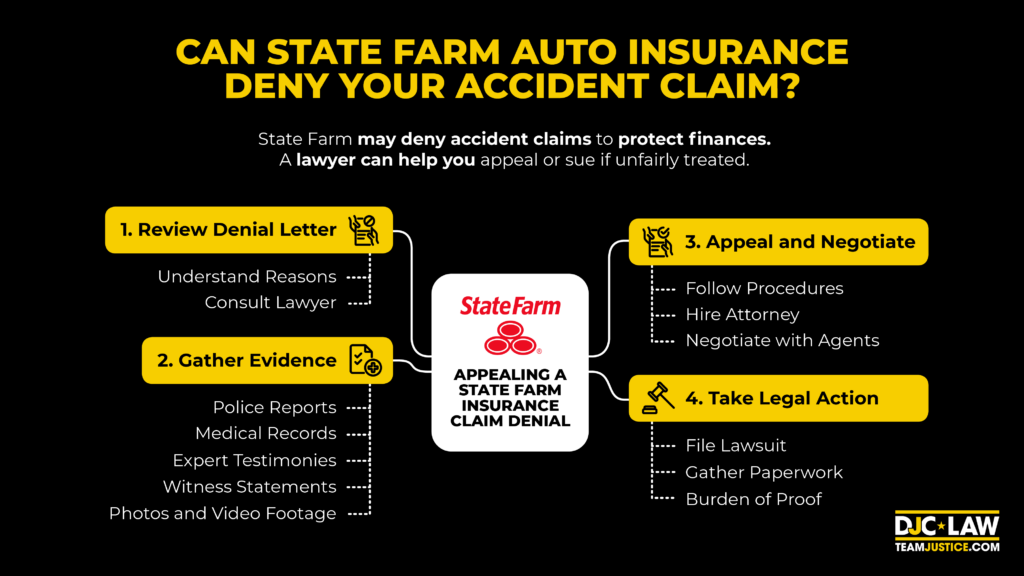

Can State Farm Auto Insurance Deny Your Accident Claim?

State Farm is entitled to deny your accident claim. Insurers are in the business of protecting their bottom lines rather than protecting their customers. Like all insurers, State Farm will search for any reason to deny a claim or reduce how much you’re entitled to. In all cases, consulting a personal injury lawyer can enable you to push back against your denial.

Car accident attorneys know the system, and you have the right to review why your claim was denied and appeal. Likewise, if you believe you were treated unfairly, you can file a personal injury lawsuit against State Farm themselves.

Follow these steps if your State Farm claim is denied.

Review Your Insurance Claim Denial Letter

State Farm is legally bound to send you a denial letter outlining why they denied your claim. Read and review this letter to get an idea of why they denied your claim. It’s also the basis for your appeal.

Some of the more popular reasons State Farm likes to deny claims include:

Your policy lapsed

Failed to claim within allowable limits

Incomplete information

Inaccurate information

Breaking State Farm policy

Not enough documentation

Injury disputes

At this stage, you should hire a legal professional to decide on your next steps.

Gather Further Evidence for Your Auto Insurance Company

Overturning a claim denial requires extra evidence to show that your claim was denied unjustly. What evidence you provide depends on the reason for your denial. Examples of evidence you might seek out include:

Official police reports

Medical documentation

Expert witness testimony

Eyewitness statements

Extra photos

Video footage

Appeal and Negotiate

If you decide to appeal, you must follow State Farm’s denial appeal procedures. Making any mistakes will only delay your claim further and make it even less likely that you’ll get a decision in your favor. That’s why getting an attorney to do this makes sense.

Moreover, expect to deal with a State Farm agent. You’ll usually have to negotiate with them to get the compensation you deserve. Remember, these representatives aren’t your friends and will use any number of strategies to find a reason to continue to deny your claim.

Take Legal Action

It’s more common than you think for State Farm to stick to their guns and to continue to deny valid claims. If so, you can file a lawsuit against the insurance company. The burden of proof is on the plaintiff, so ensure you work with a legal professional who can gather all the necessary paperwork to support your claim.

Steps to Take After a Car Accident

How you react after an accident determines whether you can claim the full extent of your losses, including medical expenses, lost wages, and pain and suffering. Follow these steps after your car accident, and consider consulting our Expert Austin car accident lawyers to protect your rights and ensure a fair settlement:

Step One – Get yourself to safety and seek medical attention if you’re severely injured. Call 911 and wait for an ambulance to arrive. Even if you’re not injured, you should call 911 anyway and ask for a police officer to attend.

Step Two – Exchange insurance details with the driver. It’s your legal obligation to provide valid insurance details, or you could be charged with a hit-and-run violation.

Step Three – Gather evidence from the accident scene using your smartphone. Take photos and videos, focusing on the vehicles and any visible injuries. It’s also a great idea to search for any eyewitness testimonies and ask for their contact details.

Step Four – Wait for the officer to arrive and fill out an official police accident report. Once all the formalities are out of the way, you should visit a medical facility for a checkup. Bear in mind that injuries like concussions and whiplash can take hours to arise.

Step Five – Inform your insurance company that you were in an accident and call a lawyer as soon as possible to launch your claim.

How Long Does a Car Accident Stay on Your Record?

Car accidents stay on your insurance record for three to five years. How long an accident remains visible depends on your state’s laws and the nature of the accident. Every state has its own set of data retention laws.

For example, New York State maintains most accidents on your record for four years plus three more years. After the total seven-year period has elapsed, the data will be removed from your standard driving record entirely.

Some states might even maintain all accident records for life. Despite the cutoff period for the standard driving record, that doesn’t mean you have to contend with high premiums forever. Insurance companies review shorter driving records going back for three to five years.

On a side note, it’s worth mentioning that some types of accidents stay on your record for longer. If you were convicted of a DUI, it might stay on your standard driving record for up to ten years. Likewise, if you committed vehicular homicide, this is the type of incident that never leaves your record.

Never admit any fault or make projections about the incident or who was at fault. Initially, the correct answer is to keep it factual and to say as little as possible. Let your lawyer do the talking so you don’t accidentally derail your claim.

State Farm Accident Forgiveness FAQs

Who gets State Farm’s best auto insurance rates?

Drivers with a good driving record get the best rates on auto insurance from State Farm. Ideally, you’ll have a clean driving record, few to no claims on your insurance history, and a great credit score. You can also ask about State Farm’s discounts that may apply to you.

What happens after I use my accident forgiveness?

Accident forgiveness is usually limited to a set period. Once you have used your accident forgiveness, you won’t be able to protect yourself from rate rises for a specific time period.

For example, if you can have one accident forgiven in three years, the second accident in that period would be treated as if you had no forgiveness at all.

Does accident forgiveness actually work?

Accident forgiveness is something of a misnomer. You’re protected from immediate rate rises, but you’re not protected from future rate rises. Plus, you’re still paying extra for forgiveness in the first place, regardless of whether you use it. Most drivers will not make any significant savings from having this add-on.