Being in a car accident is stressful enough, especially if you’ve suffered a severe injury. If the car accident exceeds insurance limits, that adds another layer of stress and frustration. Your bills are mounting, and you have no idea how you’re going to pay them.

The following is a look at some of your potential options if you find yourself in this unfortunate situation. Hiring a skilled car accident attorney will be your best chance of obtaining the compensation you deserve, especially if the car accident exceeds the at-fault driver’s insurance limits. Allow a seasoned professional to handle this complex claim process.

An Overview of Insurance Limits

Understanding insurance limits is somewhat like deciphering a complex code. Insurance limits determine the financial boundaries of a policy. When a car accident exceeds insurance limits, it’s essential to have an idea of the intricacies of insurance coverage, shortfalls, and your available options for obtaining compensation.

Insurance limits are predefined thresholds representing the maximum amount an insurance company commits to pay for specific claims. In the context of car insurance, these limits primarily encompass bodily injury liability and property damage liability. Here’s a brief look at each.

- Bodily injury liability: This facet of insurance limits pertains to the maximum amount the insurer will pay for injuries caused to others in an accident where the policyholder is at fault. For example, suppose the bodily injury limit is $50,000 per person. In that case, the insurer will cover medical expenses and related costs up to this specified amount for each person injured in the accident.

- Property damage liability: This aspect involves the maximum amount the insurer will pay for damages to another person’s property. In the event of an accident, if the property damage liability limit is $50,000, the insurer will cover repair or replacement costs for the damaged property up to this specified amount.

What Happens When There’s a Shortfall?

Consider a scenario where the at-fault driver’s insurance policy has a bodily injury limit of $50,000 per person. Now, envision an unfortunate situation where the injured party incurs medical expenses totaling $70,000 or more. That’s not an exaggeration by any means. Rehabilitation for a severe traumatic brain injury can run as high as $1,600 per day.

The financial gap exposes a critical challenge for the injured party — finding money to pay for the remaining costs after coverage runs out.

This shortfall isn’t just a hypothetical exercise. It’s often a tangible and distressing reality for those grappling with the aftermath of an accident. It underscores the importance of understanding the limitations of insurance coverage and exploring alternative avenues for securing the compensation necessary to cover the full extent of damages.

When faced with a car accident that exceeds insurance limits, people suddenly encounter incredibly formidable challenges. Navigating beyond these limits requires the strategic approach of a car accident attorney.

Here’s some information on three primary options available to injured parties looking for fair compensation – uninsured/underinsured motorist coverage, filing a lawsuit against the at-fault driver, and taking action against a third party.

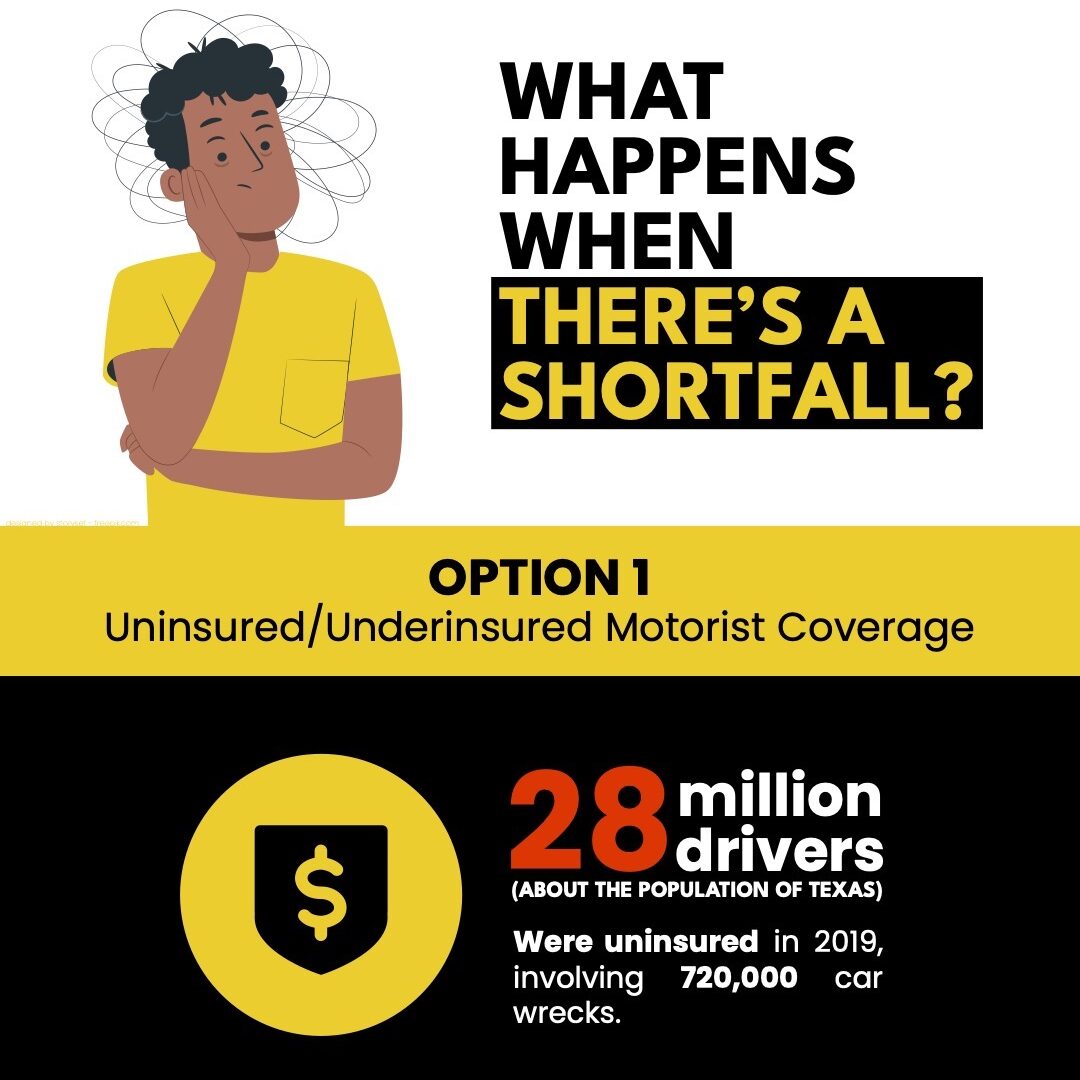

Option 1: Uninsured/Underinsured Motorist Coverage

The numbers regarding uninsured and underinsured drivers in our country are troubling. According to the latest statistics, there were about 28 million uninsured drivers in the United States in 2019. That’s about one in eight drivers or 12 percent.

There are about 6 million car wrecks in the US yearly. When you do the math, approximately 720,000 of those wrecks involve uninsured drivers.

Statistics regarding underinsured drivers – those with coverage but whose policies aren’t enough to cover most damages from an accident – aren’t available. But it’s not a stretch to say hundreds of thousands of accidents involving those drivers occur yearly.

Understanding Uninsured/Underinsured Motorist Coverage

If you’re in a car accident exceeding insurance limits, you can turn to your uninsured/underinsured motorist (UM/UIM) policy. Even though this can be a lifeline for people, only 21 states require drivers to carry this coverage.

A UM/UIM insurance policy bridges the financial gap left by insufficient coverage from the at-fault driver. In essence, it allows the injured party to turn to their own insurance provider for compensation when the responsible party’s coverage proves inadequate.

The Fine Print

But while the potential benefits of UM/UIM motorist coverage are clear, its availability and extent aren’t the same across all insurance policies. The terms and conditions governing this coverage can vary significantly from one policy to another, making it essential for policyholders and their lawyers to meticulously analyze the fine print.

Unfortunately, not all insurance providers offer the same level of protection. The scope of coverage they provide will influence the compensation you’ll receive. Thoroughly understanding these nuances is pivotal in unlocking the full potential of UM/UIM coverage.

Navigating Policy Specifics

We can’t overstate how essential it is for you to know the specifics of your UM/UIM coverage. You and your attorney must look deeply into your policy to understand the details. Key aspects to consider include coverage limits, deductible amounts, and any exclusions that might affect the policy’s applicability.

Option 2: Suing the At-Fault Driver

What if a car accident exceeds insurance limits and you don’t have UM/UIM coverage? If that’s the case, your only recourse will likely be to sue the at-fault driver. But this is a highly complex undertaking laden with challenges and uncertainties. These are just a few.

Legal Hurdles and Protracted Processes

Suing the at-fault driver directly is far from a straightforward path. Legal complexities and bureaucratic hurdles often extend the process, leaving injured parties needing clarification regarding the resolution of their claims. The intricacies of the legal system, including filing procedures, court appearances, and adherence to legal timelines, contribute to the complexity.

Burden of Proof and Evidentiary Challenges

Establishing liability and proving the extent of damages become essential in a legal battle. The burden of proof lies squarely on the shoulders of the injured party, requiring a comprehensive presentation of evidence. This includes police reports, medical records, witness statements, and expert testimonies. The challenge lies in gathering this evidence and presenting it persuasively within the confines of legal standards.

Uncertainty of Legal Outcomes

Legal proceedings inherently involve an element of unpredictability. Despite a compelling case, the outcome in court is subject to the interpretation of the law, the judge’s discretion, and the effectiveness of legal arguments. This uncertainty adds a layer of stress and anxiety to the already challenging process as injured parties await the resolution of their claims.

Financial Challenges

Will it even be worth taking legal action in the first place? After all, if the at-fault driver doesn’t have the money to pay for full coverage, how can you expect them to pay for your damages?

One of the most formidable obstacles in suing the at-fault driver revolves around their financial capacity to cover awarded damages. Even if you successfully prove liability, the actual collection of compensation hinges on the availability of the at-fault driver’s assets. If these assets don’t cover the amount a judge or jury awards, you’ll have difficulty obtaining the full extent of the damages the court grants.

In addition to personal assets, the at-fault driver’s insurance coverage plays a crucial role in determining the financial feasibility of legal action. If the driver has coverage, but the policy’s limits won’t meet the awarded damages, you’ll likely find yourself in a precarious position. Some policies have payout caps or limitations on specific damages, further complicating the prospects of obtaining full compensation.

In extreme cases, the at-fault driver may opt for bankruptcy to find financial relief. This decision can severely impact your ability to recover damages, as bankruptcy proceedings may discharge or reduce the at-fault driver’s liability. Navigating through bankruptcy-related legal complexities adds yet another layer of difficulty for those seeking compensation.

Option 3: Third-Party Liability

If those are your only options, you’ll have a challenging time getting the money you need to pay for your medical bills, lost income, and other damages you’ve incurred.

But a third option might be the answer – taking action against another party that contributed to the accident.

What if the at-fault driver hit you because their brakes failed? The mechanic who supposedly fixed them may have been negligent. The brakes could have been defective due to negligent manufacturing. What if a tire blew out because it was defective? You can take legal action against the negligent party in these scenarios.

What if the at-fault driver was impaired because they were drunk? You can possibly sue the establishment that over-served them.

The Third-Party Liability Investigation Process

Other scenarios can provide an opportunity for action against a liable third party. But your attorney must investigate to see if those scenarios exist. This investigation aims to unravel the complexities of the accident scenario, providing a more comprehensive understanding of liability.

Here are some of the components of an effective investigation.

Accident Reconstruction

This specialized field involves the recreation of the events leading up to and during the accident. Attorneys may collaborate with accident reconstruction specialists to gain a precise understanding of how the incident unfolded.

Reconstruction allows for a detailed analysis of factors such as vehicle speeds, road conditions, and the actions of all involved parties. This analysis can reveal additional elements that others might have initially overlooked.

The findings from accident reconstruction often serve as valuable evidence in legal proceedings. Expert testimony from reconstruction specialists can provide a compelling narrative of the accident sequence, helping establish third parties’ liability.

Witness Interviews

Gathering statements from witnesses who observed the accident is instrumental in gaining insights into the actions of all parties involved. Witnesses may include:

- Individuals present at the scene.

- Passengers.

- Individuals who arrived shortly after the incident.

Witnesses may provide information that points to the involvement of third parties. Examples of third-party involvement can include:

- A pedestrian crossing the street recklessly.

- A nearby construction site impacting road conditions.

- A malfunctioning traffic signal.

Attorneys document witness statements accurately and comprehensively. Varied perspectives from witnesses can contribute to a more detailed understanding of the events leading to the accident.

Identification of Potentially Liable Third Parties

Accident reconstruction and witness statements allow attorneys to connect the dots and identify potentially liable third parties. This can involve entities or individuals whose actions, inaction, or negligence played a role in the accident.

With a clearer picture of all contributors to the incident, attorneys can expand liability claims beyond the at-fault driver. This strategic approach broadens the scope of potential compensation sources.

Attorneys may work with various experts beyond accident reconstruction specialists, depending on the nature of the case. For example, experts in fields such as traffic engineering or safety regulations can highlight environmental factors contributing to the accident.

This approach strengthens the attorney’s ability to identify and pursue claims against third parties.

Building a Case

Your car accident lawyer will meticulously document all findings from the third-party liability investigation. These findings include creating a detailed timeline of events, compiling expert reports, and preserving witness statements.

Armed with this wealth of information, your attorney will develop a strategic legal approach to help formulate the most robust third-party claim possible.

Don’t Hesitate To Contact a Car Accident Attorney

When a car accident exceeds insurance limits, injured parties have options. Understanding the available options, such as UM/UIM motorist coverage and pursuing legal action against the at-fault driver or a third party, is crucial for obtaining the compensation needed to recover from the accident’s physical, emotional, and financial toll.

A skilled personal injury lawyer can make a significant difference in the outcome of a case. From providing legal advice and negotiating with insurance companies to representing clients in court, attorneys play a vital role in ensuring injured drivers receive the compensation they deserve.

By exploring these options and seeking professional legal guidance, you can navigate the complexities of the aftermath of a car accident and work toward rebuilding your life. Please speak with a car accident lawyer as soon as possible.