Illinois is home to one of the country's largest cities, which means your chances of being involved in an accident are significant. According to the American Community Survey 2018-2022, 89.1% of households in the Prairie State own at least one vehicle. That’s a lot of chances to find yourself involved in an accident.

As the number of vehicles increases, more strain is placed on the road systems, leading to more accidents. According to Forbes, you have a one in 93 chance of being killed in an auto collision in the U.S. today. However, there’s an even higher chance of being involved in a non-fatal crash, meaning you’ll need to deal with the at-fault driver’s insurance company.

In today’s guide, we’ll discuss how to deal with the at-fault driver’s insurance company and the steps you’ll have to take to make a claim.

Key Takeaways

Car insurance claims involve claiming with your insurer or the other driver’s insurer. Your claim would be against the other driver’s insurance provider for your damages in an at-fault state.

Avoid saying anything to the other driver’s insurance company. Anything you say can and will be used against you to pin liability on you, downplay your injuries, or cloud what actually happened.

Redirect all communications to your attorney from the other driver’s insurance company, and never agree to provide a recorded statement.

If the at-fault driver has no insurance, you may be able to claim through your uninsured/underinsured motorist coverage, or you can file a lawsuit against the other driver personally.

In all cases, hire an attorney to deal with the at-fault driver’s insurance company and let them take control of proceedings.

What is a Car Insurance Claim?

An auto insurance claim notifies your insurance provider that you’ll need to use your policy to cover your expenses after you were injured in a car accident. In an at-fault state, this is a claim against the other person’s insurance, meaning if you succeed, the other driver’s insurer pays out.

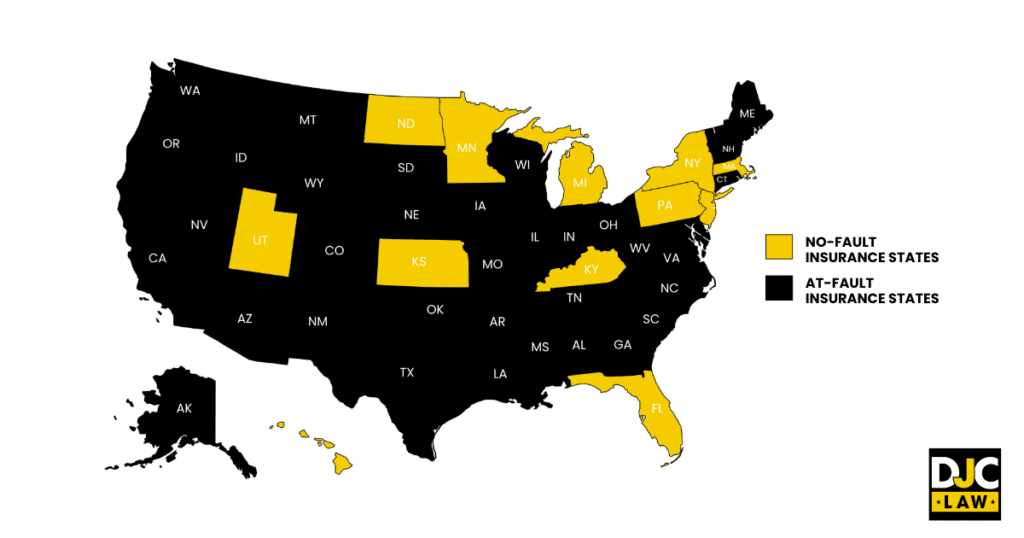

According to Liberty Mutual, 38 states work precisely like Illinois in that they’re at-fault states. The remaining 12 states are no-fault states, which means you’ll claim from your own auto insurance company, regardless of who’s at fault.

How you make a claim with a car insurance company depends on the provider’s processes. Sometimes, you’ll have to call them directly, whereas others allow you to use an online form or an app.

What Can You Say to the At-Fault Driver’s Insurance Company?

Say nothing to the at-fault driver’s insurance company. Let your own auto insurer and your car accident attorney manage all communications. Anything you say can and will be used against you to limit how much your settlement is worth. Consider ignoring all calls and voicemails or redirecting them to your attorney.

According to the Consumer Federation of America, auto insurers reaped nearly $30 billion during the pandemic era. So, what does that tell you? It says insurers are experts in reducing their liabilities, and that’s why talking to them can hurt your claim.

Insurance adjusters are professionals in prompting people to make statements that limit how much they can claim. Many people are unaware of these tricks, believe they’re there to help or don’t realize what they’re saying because they’re still in shock.

In short, there’s no benefit to speaking to the other driver’s insurance company. Remember, you’re not obliged to speak to them if you have an attorney representing you.

Should You Allow the Other Driver’s Insurance Company to Record You?

Never allow the at-fault driver’s insurer to record your conversation. All recordings can be used during legal proceedings to damage your case. All statements should be made through your attorney.

You’ll have to speak to your own insurance company, though. After your accident, you’re required to report the accident within 24-72 hours, depending on your policy’s terms. Again, keep everything factual and don’t attempt to speculate, even in passing.

How Does Insurance Work When It’s Not Your Fault?

Auto insurance in Illinois works based on the concept of fault. If you weren’t at fault for an accident, you’re entitled to file a claim for all economic and non-economic damages with the at-fault driver’s insurer.

Your lawyer will work to establish proof of liability and the extent of your damages before coming to a dollar value. The other insurer will typically offer a settlement. In most cases, the first offer is far below what your case is actually worth, so it’ll typically take some negotiation to get a fair figure.

If there are issues proving liability or extracting a fair settlement, your lawyer can file a lawsuit and take the issue to court. Despite how scary this sounds, very few cases actually go to court. According to the Bureau of Justice Statistics, 73% of cases end in an agreed settlement.

Note that once you have agreed to a settlement with the insurance company or received a judgment, you cannot ask for further damages later. Accepting a compensation package means you waive your rights to pursue the defendant for the same incident later.

How to Deal With At-Fault Driver’s Insurance Company

Redirect all communications from the at-fault driver’s insurance company to your attorney. Be calm and polite. Remember, you’re not obligated to speak to the other driver’s insurer, and there’s no downside to refusing to speak to them directly.

The insurance company works for themselves and the at-fault driver. It’s their job to reduce their damages, meaning you shouldn’t cooperate with them. Your attorney knows all their tricks and will act as a shield against their most common tactics.

Some of the strategies insurers use in these situations include:

Pressuring You – The insurer will try to pressure you into providing a recorded statement before the complete police report is released or their insurance adjuster has thoroughly investigated the accident. Rushing you could derail your case by getting you to admit liability.

Deny Responsibility – You may receive a call from the insurer, who denies their client was at fault for one reason or another. Immediately, they may refuse to offer any settlement, hoping you’ll go away.

Using Your Medical History – Insurers have tricked people into signing medical release forms before to gain access to their medical history. They will use anything in your history to try to claim that your injuries were pre-existing.

Underestimating Losses – Another tactic is to underestimate your losses by giving you a lowball offer, hoping you’ll accept. Accepting these types of offers will usually leave you with significant uncompensated losses.

Auto insurers prefer profits to justice, so they’ll use every trick in the book to damage your claim. The average person isn’t equipped to deal with the intricacies of these cases, which is why letting a personal injury attorney step in is the right way to go.

In the meantime, don’t speak to the other driver’s insurance company at all.

Is Illinois an At-Fault State for Auto Accidents?

Illinois is an at-fault state for auto accidents. In an at-fault state, the at-fault driver’s insurer pays for any losses sustained due to the policyholder’s actions. In contrast, no-fault states involve drivers claiming with their own insurers, with fault not being a factor.

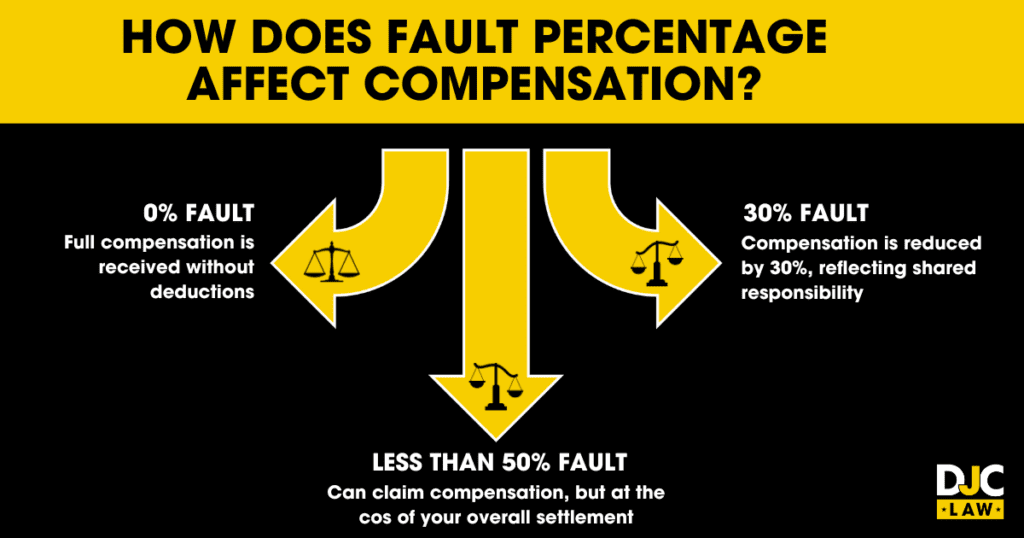

Fault in Illinois isn’t as clear-cut as pinning the blame on a specific person. According to the Illinois Department of Insurance, the Land of Lincoln has adopted modified comparative negligence rules as the standard for these types of claims.

Under these laws, you can only claim compensation if you’re less than 50% responsible for the accident. During your car accident investigation, you may be apportioned some blame for the incident.

What impact will this have on your settlement?

Assuming that you’re less than 50% at fault for your injuries, you can still claim compensation, but at the cost of your overall settlement. For example, if you’re considered to be 30% responsible for your accident, your final settlement will be reduced by 30%.

What Happens if You Have No Insurance But the Other Driver Was At Fault in Illinois?

Illinois requires that all drivers carry insurance while driving on public roads. If you don’t have insurance, you can still claim compensation for your injuries, but you may receive a reduced settlement and be subject to legal penalties.

According to the Insurance Information Institute, 16.3% of drivers in Illinois are uninsured, so these types of accidents are more common than you think. Although you wouldn’t call your own insurer if you were uninsured, you can file a claim against the at-fault driver’s insurance company and make a claim.

What if the At-Fault Driver Has No Insurance?

Colliding with an uninsured driver raises issues in an at-fault state like Illinois because there’s no insurer against which to file a claim. However, you can still file a claim with your own insurance company or file a personal injury lawsuit against the driver.

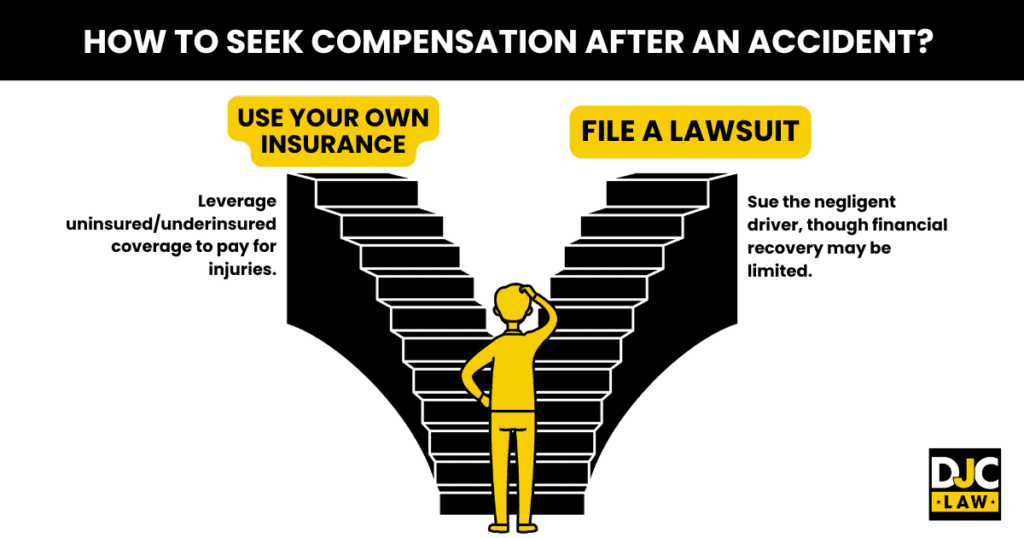

Your two options are:

Using Your Own Insurance – Insurers offer uninsured/underinsured coverage for these exact situations. If you have this coverage as part of your insurance package, you can enact it, and your own insurance company will pay for your injuries.

File a Lawsuit – The other option is suing the driver for their negligence. The problem is that if a driver doesn’t have insurance, they probably don’t have the financial resources to pay an award anyway.

As you can see, this is why driving without insurance is so important. Whether you’re on the receiving end of being hit by an uninsured driver or you are the uninsured driver, insurance coverage ensures that all your expenses can be covered.

What Steps Should You Take After a Car Accident That’s Not Your Fault?

Dealing with a car accident that’s not your fault begins by filing a claim with the other driver’s insurance company, gathering evidence, and using your lawyer to steer your case to a positive conclusion.

File a Claim With the Other Driver’s Insurance Company

In an at-fault state like Illinois, your claim should be against the other insurance company. It’s the first thing you should do after notifying your own insurer that you have been involved in an accident.

How you make a claim depends on the insurance firm’s processes. It may include filling out an online form, making a phone call, or using an app. Details of the firm's claims procedures should be available on its website.

Issues That Can Happen When Filing a Claim

Expect resistance whenever you make a claim. Don’t be put off when the insurer asks for more evidence, tries to downplay your injuries, or attempts to pin the blame on you. All personal injury lawsuits are evidence-based, so rely on the evidence.

Examples of evidence you can use to refute the objections of the other insurer include:

Medical reports

Police accident reports

Eyewitness testimonies

Photos from the scene

Videos from the scene

Traffic camera footage

Dashcam footage

The golden rule is that you can never have too much evidence to support your claim. That’s why we always recommend using your phone to gather evidence of what happened at the accident scene.

Use Your Own Insurance Firm

Your insurance company can be helpful because, in this case, they’re not paying out any potential settlement so that they can help. Ask them for advice on how to file a claim or how to claim on your uninsured/underinsured motorist coverage.

Contact a Chicago Car Accident Lawyer

The at-fault driver’s insurance company has no interest in paying car accident victims a fair settlement because it hurts their bottom line. Instead, they’ll do everything to get you to admit fault, downplay your injuries, and pressure you into accepting a lowball settlement.

Working with Chicago car accident lawyers enables them to take control and deal with all communications from then on, including communications with your insurance company. It prevents mistakes and gives you peace of mind while you recover from your injuries.

What Happens When the At-Fault Driver’s Insurance Won’t Pay?

Refusing to offer a settlement is a standard tactic insurance companies use to get drivers to give up. If there’s any discussion over who was to blame or substantial differences in the claim's value, the auto insurer may refuse a settlement entirely.

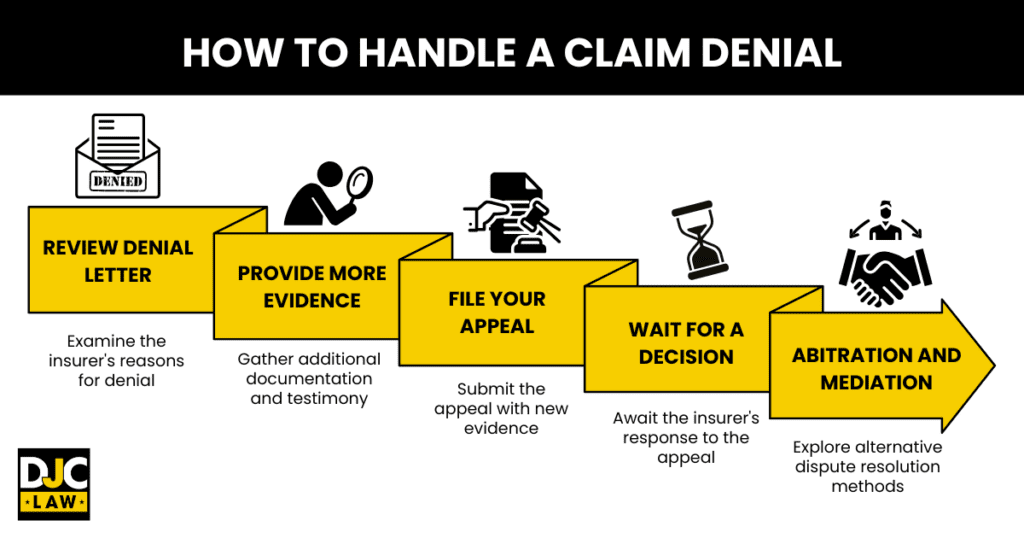

You’re entitled to appeal against any decision an auto insurer has made on a settlement, and many allow you to appeal more than once. Here’s how to handle a claim denial:

Review the Denial Letter – All insurers must send you a claim denial letter outlining why they refuse to pay. Understand on which grounds the insurer won’t provide a settlement.

Provide More Evidence – Work with your attorney to collect additional evidence, such as further documentation of the scene and expert witness testimony.

File Your Appeal – Formally file your appeal through the insurer’s internal appeals process. This should include all the extra evidence you’ve gathered. Address the reasons for denial directly.

Wait for a Decision – The at-fault driver’s insurer will process your appeal and get back to you. Use your lawyer to pressure them into providing a prompt decision.

Arbitration and Mediation – Before committing to a lawsuit, consider methods like arbitration or mediation. These tools can help you to reach a settlement faster. Ask your lawyer whether this is suitable for your situation.

But what if your appeal is still denied?

If this occurs, your next step is to file a lawsuit against the insurance company. Filing a lawsuit is a move that often pays dividends because no insurer wants the cost of going to a court trial. In many cases, simply filing a lawsuit is enough to get them to come to a settlement.

After filing a lawsuit, your Chicago car accident lawyer will go through the process of filing all the proper forms and building your case. Further negotiations will take place, and if a settlement cannot be reached, you’ll receive a trial date. In the rare situation where you must attend court, your lawyer will brief you and guide you through the process.

How Can a Chicago Car Accident Lawyer Help?

Hiring a personal injury law firm to fight your case is the smartest way to obtain a settlement reflecting your losses. An experienced legal mind explores every avenue of compensation and uses their expertise to disarm unscrupulous insurers looking to get out of their obligations.

Some of the ways your lawyer helps include:

Building your case by gathering evidence.

Providing objective advice throughout the process.

Giving you a realistic case value.

Offering you the breathing space needed to recover from your injuries.

Taking control of negotiations.

Maximizing your settlement amount.

Lawyers know how insurers operate, and they’ll stop you from getting into a situation where your accident can be questioned on liability grounds. They’ll also show the true extent of your injuries and stop them from being downplayed. If you’re ready to maximize your settlement, contact a lawyer immediately after your accident.

How Much Compensation Can You Get for a Car Accident in Illinois?

Every accident is unique, so there’s no way to predict how much you could be entitled to. Consult a lawyer who can review your accident and provide an estimated settlement value to which you could be entitled. Generally, case values depend on the extent and impact of your injuries.

Examples of the damages you could be entitled to include:

Medical costs

Lost earnings

Property damage

Lost future earnings potential

Wrongful death

Loss of companionship

Loss of enjoyment of life

Home/car modifications

Settlement awards can range from a few thousand dollars to millions of dollars. Unlike some states, Illinois has no cap on damages in these cases. What’s certain is that hiring a lawyer is the best move you can make. According to Nolo, plaintiffs who represented themselves received $17,600 on average, compared to plaintiffs with lawyers who received $77,600.

At-Fault Insurance Claims FAQs

What does “fault” mean on an insurance claim?

A fault claim is a type of claim where you were at fault for an accident, or a successful claim was made against another party, but the damages couldn’t be recovered for one reason or another. For example, if your car was stolen or vandalized, your claim may be registered as a “fault” claim. Depending on your insurer, it could mean your insurance premiums will rise.

Will insurance pay out a car accident insurance claim if it was my fault?

Your car insurance policy provider will pay out damages to the other driver if you were at fault for the accident. However, if you have damages, you can still be covered for the cost of repairing your vehicle if you had collision coverage as part of your insurance policy.

Who covers my injuries in an auto accident?

In an at-fault state, the at-fault driver’s insurance will pay for your damages. However, if you were at fault for the accident, your insurer may have to cover your medical bills and the other driver’s costs.

You can take out special coverage options, such as MedPay or Personal Injury Protection (PIP), to help cover your medical expenses, regardless of who was at fault. PIP also pays out for non-medical expenses and lost wages, even if you were the cause of the accident.